This holiday season is bound to be unique. Unique because it will be reminiscent of pre-pandemic routines, given that most economies have opened. Yet, it will be significantly rooted in the shopping patterns instilled by the new normal. A recent survey revealed that 41% of holiday shoppers plan to purchase online more than they typically would to avoid crowds/exposure. Moreover, drawing from their past experience of product unavailability and shipping delays many began their holiday shopping as early as June, during Amazon’s Prime Day.

According to Deloitte, this festive season’s e-commerce sales is expected to grow by 11-15% Y-o-Y, an estimated increase of between USD 210 billion to USD 218 billion. For online brands and retailers eager to maximize their share of the holiday pie, understanding their customers’ purchase intent and how they plan to fulfill them will be key to winning in the coming weeks and beyond.

Savvy players are already putting their ears to the ground to evaluate how current market dynamics and evolving consumer behavior will impact their demand, pricing, positioning, fulfillment, etc., during these major sales days. And that’s where in-depth market and consumer intelligence comes in.

In context with this season’s peak rush, market intelligence is enabling businesses to assimilate and analyze multiple internal and external data points to navigate rapidly shifting market scenarios proactively. As for consumer intelligence, it’s helping savvy players gain insight into critical questions about the what, why, and so what of emerging consumer behavior and shopping patterns. To help businesses understand how these studies can maximize ROI out of holiday game plans, let’s dive right in:

Leveraging market intelligence to drive a result-oriented holiday performance

Identify product categories that will do well

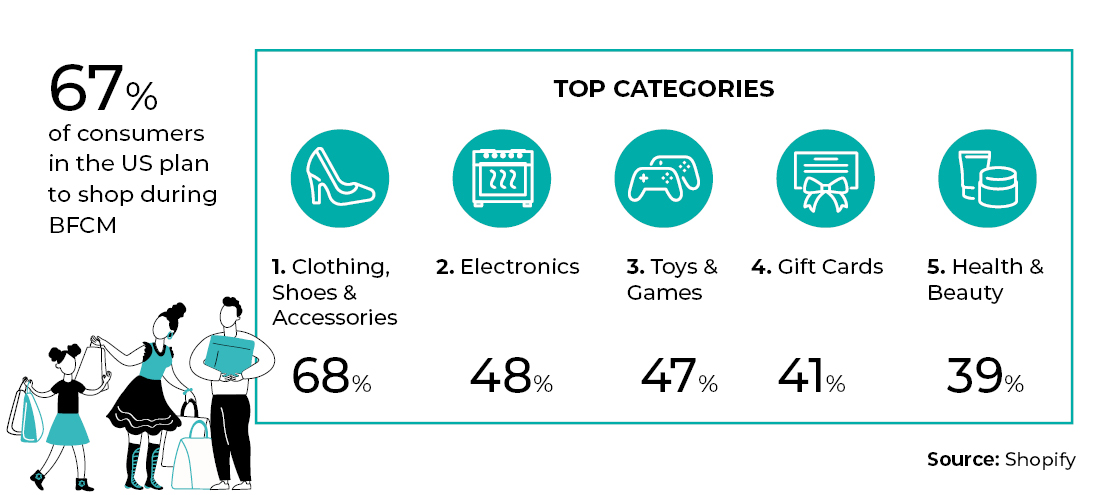

A common concern for retailers and brands selling online is deciphering which products are slated to perform and which ones need that extra push. This is especially critical for planning ahead of the Black Friday Cyber Monday (BFCM) period. Last year, despite the economic downturn and most people staying indoors, categories like clothing and beauty saw considerable traction.

This would seem quite contrary given that social gatherings were sparse. But players who were monitoring the e-commerce landscape would have been ready to leverage on this trend, given how mid-2020 saw a lot of revenge spending afforded by unfulfilled vacation plans among other unexhausted recreational budgets. E-commerce players would therefore do well to analyze past data and benchmark them against current buying patterns to gain adequate foresight into the best-selling items this season.

Stay proactive on inventory management and supply chain logistics

Under general circumstances, most businesses would have a fair estimate of which products will fly off the digital shelves and which need relatively lower replenishment cycles during the holiday season. But the current new normal demands new and innovative measures. For players to ensure no potential sale goes unmissed taking the data-driven approach is imperative.

E-commerce transactions create scores of data every day. Yet, only 16% of retailers use this data to derive actionable insights. 24% of retailers find themselves at the beginner’s level while 60% are getting to the point of harnessing insights from their historical data. Right from inspirations for holiday product bundling to employing a market basket analysis approach to offer more precise cross-sells and up-sells these data points are invaluable.

Unpredictable inventory levels are one of the biggest reasons driving an early holiday shopping wave since the onset of the pandemic. In fact, nearly 81% of customers worldwide have experienced out-of-stock situations at least once. Through data-driven inventory planning, brands can proactively avert such mishaps and boost their profit margins while keeping expenditures minimal.

Find out how a leading supermarket chain used analytics-led inventory planning to provide highly precise sales estimates that eventually earned the firm an annual savings of USD 1.8 million.

Design a contingency plan

As with any plan, it’s worth considering Murphy’s law: anything that can go wrong will go wrong. What’s important is that your business is prepared to react quickly. Having a team ready to resolve any unanticipated issues that may occur with your site, ads, routine operations, etc., should be on your checklist.

For instance, how will you communicate to customers if the traditional “last day for free shipping” won’t be available this year because of a delivery delay? Geared with real-time insights on the latest developments will help you minimize customer frustration through timely communications as you recognize the possibility of such sudden disruptions.

Market intelligence helps you not only draw lessons from your own past but also base your decisions on the successes and failures of your competitors. It draws holistic insights to help you test and prioritize your strategically hem in the loose ends in your holiday marketing campaign strategy well ahead of time.

Enhance your customer relationships with consumer intelligence this holiday season

Analyze the end-to-end experience to improve targeting

Before the peak holiday rush in 2020, more than half (53%) of the consumers surveyed worldwide said they had recently discovered a new form of online shopping they liked—such as click and collect or purchasing in apps—and would keep it up. Moreover, retailer websites are one of the top channels for product discovery in 2021 according to a recent survey.

For e-commerce players to deliver a distinctive customer experience, knowing who their customers are and their path to purchase is imperative. Here’s where market and consumer intelligence pUser-generated content, especially customer reviews on social media are a treasure trove of actionable consumer insights. Mining these data sources helps understand how you stack up against competition by measuring brand awareness, recall, recognition, identity, and trust.

Moreover, this approach offers a comprehensive understanding of how your customers think, the search terms they use, their purchase intent, the features they are looking for, and their most-preferred fulfillment options, among other valuable metrics. Such information can help not just improve holiday sales through timely customer engagement augments but also enhance operational efficiencies during such peak periods.

Plan your discounting tactics wisely

Discounts and promotions are unanimously top holiday purchase drivers. They are what make holiday shopping worth the hype. However, as e-commerce players, poor visibility into the real profitability of these tactics across customer segments and channels water down its true potential. Often, brands and retailers end up turning to past experiences and conventional yardsticks for critical decisions, resulting in greater risk exposure, decreased margins, and lost opportunities.

Instead, you would do well to deep dive into their recent purchase history and demographic details for tangible market research insights into the kind of potential discounts that would click with specific audiences. A more granular segmentation basis their spending propensities and geographic placements can help you serve up strategic discounts based on a clear understanding of their buying power.

Minimize cart abandonment

In the US, 75% of consumers expect retailers to better understand them during their holiday shopping. Major sales events like Black Friday and Cyber Monday can make it hard to control and manage cart abandonment. Plus, recent consumer data reflects that with shoppers having limitless options literally at their fingertips mobile cart abandonment rates are 12% higher than desktop.

Slow site load times, price difference at checkout, inaccurate product information, discount code failures, secure payment concerns are a few issues that can hamper seamless holiday shopping translating to abandoned carts. By using technology-enabled consumer intelligence solutions, players can not only monitor metrics in real-time that impact the buyer’s journey. They can also detect root cause analysis of anomalies if any and iron them out ahead of the peak season.

For brands and retailers looking to ensure some certainty amid uncertain times, employing market and consumer intelligence will serve them well. Consider various factors in flux and review their potential business impact. This will help you develop a robust, data-driven market strategy, setting you up for a successful holiday period ahead.

For over two decades Netscribes has helped leading brands and retailers answer their global research, and customer experience needs with comprehensive market and consumer intelligence solutions. To know how we can help you meet and exceed your business and sales goals this peak season and beyond, contact us.