Seismic shifts in buying behavior have put enormous strain on the CPG trends, and in turn, the industry as a whole. Lockdowns and social distancing have compelled consumption-based shopping to shift online. Although CPG revenues increased by 21% year on year in Q2 2020, the Consumer Brands Association predicts that economic activity will not rebound to pre-pandemic levels until late 2021, and employment will not improve until well into 2022 or even 2023.

Savvy brands and retailers need to keep a constant pulse of evolving customer preferences, track and proactively act on shifting market movements to be relevant. To stay on the ball and claim the maximum share of this pie, take a deep dive into these 5 key CPG trends and better inform your next moves:

1. Revisited go-to-market strategies based on new consumer habits

Companies are adapting their go-to-market strategies and capabilities to fit changing consumer behaviors and expectations. This is increasingly becoming one of the foremost CPG trends for 2021. According to the Nielsen Omnichannel Shopping Fundamentals report, the number of shoppers who consider themselves “heavy” or “exclusive” online shoppers for daily goods increased by 133% between September 2019 and September 2020.

With this being one of the major CPG trends this year, several companies are increasingly focusing their efforts on online and omnichannel marketing to reach and engage customers using purpose-driven marketing. Omnichannel partnerships, creating clear channel strategies, and improving e-category management are among the top goals for CPG sales leaders.

With marketplaces and major retailers invading the name-brand territory with private labels, more CPG companies are exploring direct-to-consumer (DTC). For example, consider Perdue Farms, a meat processing company, which launched its DTC channel just three months before COVID-19 lockdowns in the United States.

Another example would be how PepsiCo launched its DTC websites Snacks.com and PantryShop.com in May 2020, which is rumored to have taken just 30 days. Snacks.com encourages travelers to “shop your favorite snacks and drinks from the convenience of your own home,” with over 100 items from brands including Lay’s, Tostitos, Cheetos, and Ruffles.

Although DTC sales are likely insignificant for a large company like PepsiCo, it is clear that the new platforms provide excellent opportunities for consumer research. The information gathered can be used to illustrate customer desires and behaviors and inform new product growth. In the future, the use of DTC channels for distributors and end-users will become an important part of the value proposition, as will competitiveness with digital disruptors and aggregators.

2. Dynamic and agile supply chain planning

During the lockdown, inventory management became a concern when people began stockpiling and production was temporarily halted. Online transactions spiked, consumption trends grew erratic leading to disrupted stocks. It was a difficult time to predict what’s next. This compelled companies to modify their supply chains, repatriate to mitigate risk and rely more on partnerships between retailers and manufacturers for demand sensing.

Top supply chain priorities for US retailers and CPG firms

Source: Microsoft and Bain & Company

Companies that automate their sales operations and create a digital ecosystem to manage their entire supply chain are finding it easier to develop sales resilience. Manufacturers all over the world have started using blockchain to improve supply chain visibility and transparency. Depending on their situations, businesses are using a mix of tactics to ensure supply security, speed, and agility.

For instance, Walmart has partnered with IBM to use its blockchain technology to digitize the entire food supply chain operation, bringing transparency to the supply ecosystem. The technology allows its employees to trace the origin of products. All it takes is a few seconds to skim through a dozen products and find out where the required product originated from, and where it is currently stored.

Many consumers themselves also want more information about the source of their foods – an answer blockchain solutions can provide. Bumble Bee Seafoods, for example, uses SAP’s Cloud Platform blockchain service to trace yellowfin tuna from the ocean surrounding Indonesia’s remote islands to a production plant and finally to the grocery stores in the US. All this data is accessible to their customers, by scanning the QR code present on the product’s packaging.

Aside from blockchain, intelligent control centers that use automation such as AI, IoT, and robotics to track, monitor, and manage operations to optimize the entire system also increase transparency and uniformity across the supply chain. Supply chain control towers may also be used to locate gaps and bottlenecks in existing processes, and identify alternate routes to market in such cases. Around 12% of businesses are using AI in their warehouses, according to the 2020 MHI Annual Industry Report. This number is projected to rise to 60%+ in the next six years.

For instance, after its 2012 acquisition of Kiva Systems, which was renamed Amazon Robotics in 2015, Amazon now employs over 200,000 robots in its warehouses. Robots assist warehouse employees in picking, arranging, storing, and stowing packages in 26 of Amazon’s 175 fulfillment centers.

3. Focus on sustainability, immunity-boosting self-care products

Cannabidiol (CBD) goods are consistently growing in the self-care segment. CBD goods were not legal in the United States until 2018. However, they are now used by an estimated 28% of US users – and 56% of millennials. The global cannabidiol market was worth USD 2.8 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of 21.2% between 2021 and 2028.

Keeping consumer needs in mind, many CPG brands are experimenting with self-care strategies like adding prebiotics and vitamins or eliminating unhealthy ingredients from their existing products. According to a Deloitte study, 98% of businesses have reported modifying at least some of their product range to comply with current health and wellness policies. Furthermore, 79% of companies stated that key nutrient data is shown on the packaging for 81% to 100% of their food and beverage products.

According to Nielsen, environment-conscious customers in the US alone are estimated to spend up to USD 150B on sustainable goods by 2021. In the US, there has been a huge increase in the sales of organic food and a 130% growth in the sales of nutritional supplements since the beginning of the pandemic.

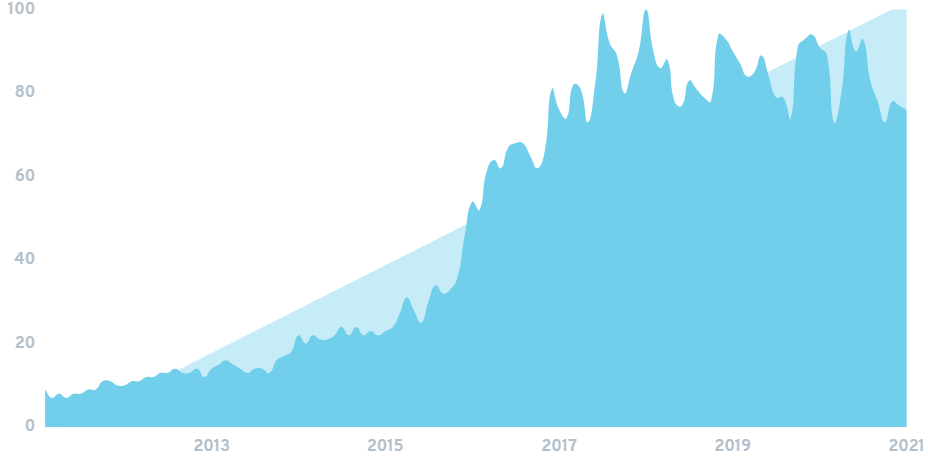

Consumer search interest in cruelty-free products and companies

Source: Exploding topics

On the other hand, consumers today would rather pay a higher price for goods packaged in environment-friendly and durable packaging. The adoption of compostable materials, as well as the production of bio-based and sustainable raw materials, has increased the demand for green packaging solutions amongst CPG companies.

The green packaging market was worth USD 266.7B in 2020 and is estimated to be worth USD 404.96B by 2026, rising at a 7.4% CAGR from 2021 to 2026, which further proves that its one of the CPG trends in the spotlight. With growing concerns about the environment, increasing pollution levels, and global warming, several brands are taking the pledge to go plastic-free and adopt more sustainable means of packaging.

4. Further emphasis on price sensitivity

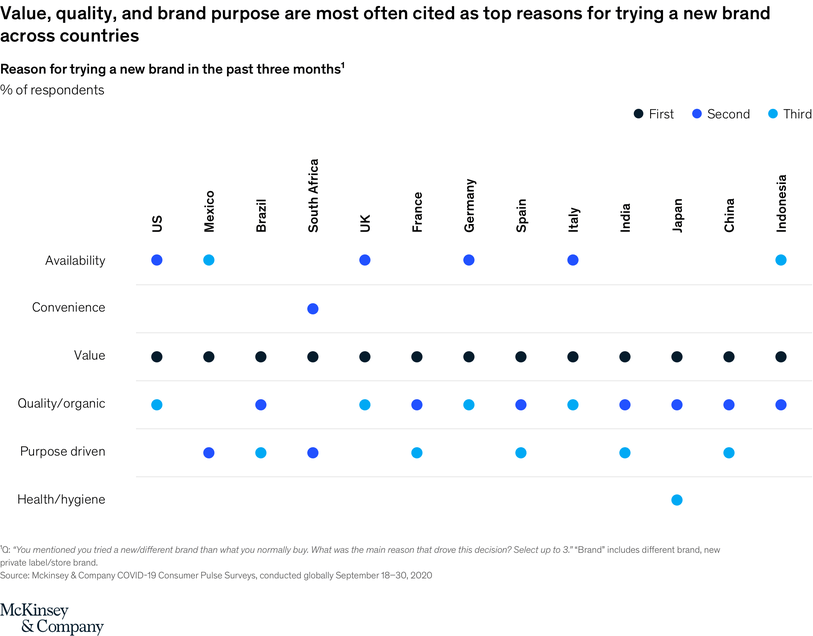

Give the current economic crisis consumers have become innately price and value-conscious. They are aggressively comparing prices online and offline and substituting their favorite brands for equivalent value-priced alternatives. Accordingly to another McKinsey study, 40% of those surveyed said they would be more diligent about their purchases, due to the pandemic. While 31% said they would switch to more affordable goods, to save money.

Source: McKinsey

With consumers becoming more price-sensitive, companies must justify the value of their goods beyond reasonable doubt to trigger conversions. Travel restrictions around the world are also hurting luxury products. Another McKinsey report stated that 20 to 30% of CPG industry revenues are generated by consumers making luxury purchases outside their home countries. These sales went down by 70% in 2020, as compared to 2019.

Companies that market luxury goods can pursue a variety of tactics, but actively discounting prices to maximize profits can be counter-productive in the long run. Prices that have been substantially reduced can be difficult to restore. CPG brands would therefore do well to reconfigure their marketing campaigns to highlight their product value and strategically convey that while the goods might be more expensive, their untainted quality makes them worth the cost.

5. Enhanced customer engagement powered by insights and technology

Covid-19 is compelling CPG brands to differentiate themselves through customized and meaningful customer experiences. Taking offline interactions online is one way to get your audience to continue engaging with their favorite brands. This has emerged as one of the major CPG trends, which puts customers first.

CPG marketers will therefore need to go beyond the commodity to fuel engagement and advocacy by delivering context-specific interactions at the right junctures of the consumer journey. For instance, Unilever, one of the world’s largest multinational consumer goods companies, has partnered with technology provider Alibaba Cloud to execute next-generation digital marketing campaigns.

Unilever will use Alibaba Cloud’s AI and cloud-based technology to optimize its brand experience across Alibaba’s Taobao and Tmall. Additionally, it will also provide the brand with valuable customer insight to design precisely targeted digital marketing campaigns.

Similarly, Procter & Gamble Company (P&G) has adopted Google Cloud’s data analytics and AI technologies to provide customers with more personalized experiences. Given this partnership, P&G will now be able to use the search engine’s consumer and media data to innovate product interactions and enhance shopping journeys for existing and potential customers.

Social media has already helped CPG companies gain momentum by allowing them to personalize engagement. Furthermore, influencer marketing, YouTube channels, blogs, etc., are all being used to build enthusiasm about brands, new releases, and to push end-users to make purchases. The adoption of smart technologies such as Augmented Reality (AR) and Virtual Reality (VR) is also radically altering how companies interact, introduce new goods, and engage with customers, all while maintaining consumer protection.

For example, Coca-Cola’s partnership with Tactic Studios to create an AR application for a brief but memorable holiday campaign, to increase customer engagement. The developers on this project incorporated a new AR feature into the Coke app, allowing customers to scan the holiday edition cans and bottles on their mobiles, for a real-time virtual scene. Within the first week of this campaign’s release, this feature’s activation had already crossed hundreds of thousands.

The Coca-Cola ad using AR technology

Source: Tactic studio

Moving forward

With the first wave of the crisis behind, CPG firms must continue to focus on attaining stability and future-proofing their businesses for long-term resilience. Savvy players willing to abandon legacy market strategies and embrace advanced and innovative ways to engage with customers will stay in the winning lane. Reliable and timely insights on changing consumer habits, evolving needs, and how they shop will be key in making the right investments and staying ahead of your competitors.

Leading CPG brands partner with Netscribes to evaluate the internal and external market forces at work, recognize CPG trends, and inform their marketing and strategic growth initiatives. To know how we can help you navigate uncertainties and stay customer-ready across channels, contact us.