Technology advancements are transforming almost every industry. Billions of dollars worth of technology investments are made each year to drive innovation, improve efficiency, and generate new avenues for growth. The technology sector also continues to attract the bulk of VC funding and, given the amount of money that is usually involved, venture capitalists bet only on the horse that brings home the prize. Analyzing VC activity can, therefore, help in identifying the technology areas which exhibit massive market potential.

Based on 2017 VC data, Netscribes identified five emerging technology trends that will impact major industries in 2018 and beyond.

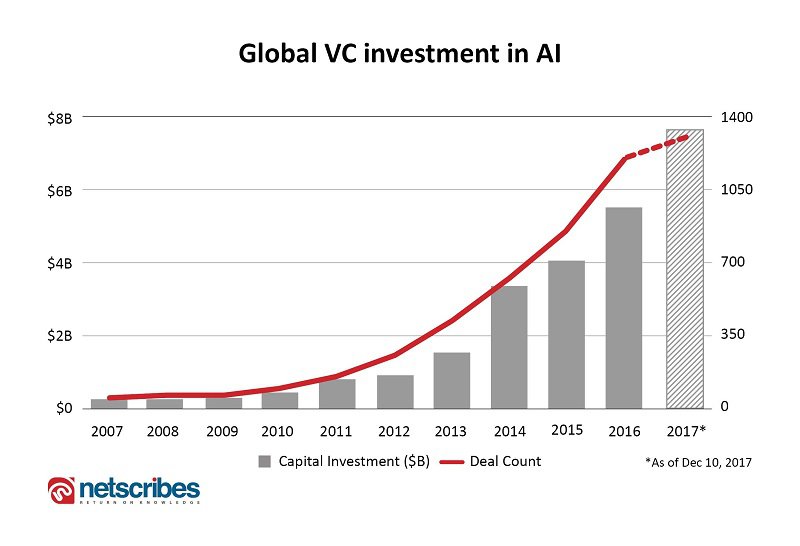

AI is all pervasive

Artificial intelligence and machine learning take the lead when it comes to technology investments. This is more than evident from two of Softbank’s most recent large bets – USD 120 million on Lemonade and another USD 93 million on Petuum Inc. Both these companies operate in different verticals, but what their flagship products have in common is AI. In fact, 2017 saw VC firms almost double their investment on AI, bringing the global total up to USD 12 billion.

Source: https://pitchbook.com/news/articles/rise-of-ai-excites-vc-investors-challenges-society

Since AI, along with machine learning, are being adopted by companies across industries, these investments are remarkably diversified. While Tencent Holdings Ltd. pumped a staggering USD 1 billion into the Chinese electric car startup NIO, Alibaba’s Ant Financial along with the state-owned Guo Feng Fund helped Face++ (a cognitive services company) raise USD 460 million.

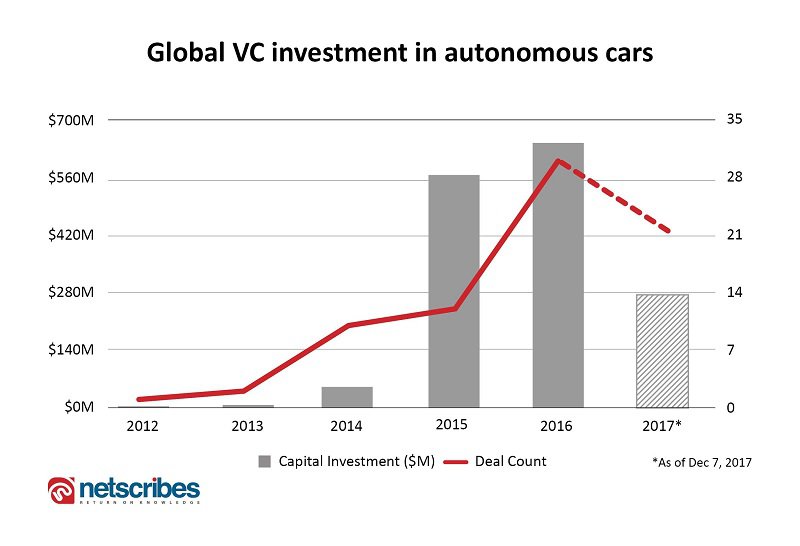

Autotech in the driver’s seat

Within the first three quarters of 2017, autotech VC deals managed to raise USD 908 million and crossed the USD 1 billion benchmark by the year-end. VC firms seem to be leaning more towards autonomous vehicle technology, fleet telematics, vehicle-to-vehicle (V2V) communication, auto cybersecurity, and connected car solutions as key investment areas.

A closer look at the VC investment in autonomous or self-driving cars shows an increasing interest in this sector:

Source: https://pitchbook.com/news/articles/self-driving-cars-and-beyond-autotech-ventures-gambles-on-ground-transportation

Chinese startup NIO’s rise to prominence only goes to show that the electric car, once relegated as a pipe dream, is back from the dead. Tesla may have had a dominant grip over the autotech segment, but VC firms are helping startups, such as NAUTO and Embark, loosen that hold.

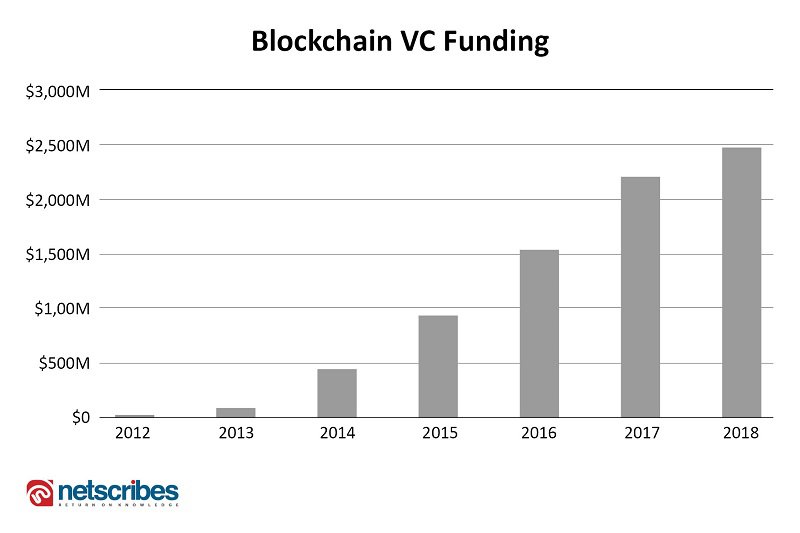

New links in the blockchain

Apart from witnessing AI become a household name in the form of Google Assistant, 2017 also saw bitcoins and blockchains step out of the shadow economy and into the mainstream as the hottest trend in fintech. Believe it or not, the amount of VC funding for Blockchain-based companies so far in 2018 has already reached more than 40% of last year’s total.

Source: https://www.coindesk.com/bitcoin-venture-capital/

Although regulatory authorities are still working hard on creating a global governance framework for cryptocurrencies, blockchain – the underlying technology – has been appropriated by a wide range of companies to power their products. In October 2017, a USD 100 million investment from SparkLabs led to the birth of the SparkChain Capital project. This early-stage fund for blockchain and cryptocurrency projects has already invested in six blockchain platforms to date. Blockchain investments, as such, are expected to grow as more and more VC firms come to recognize the opportunities that this technology presents.

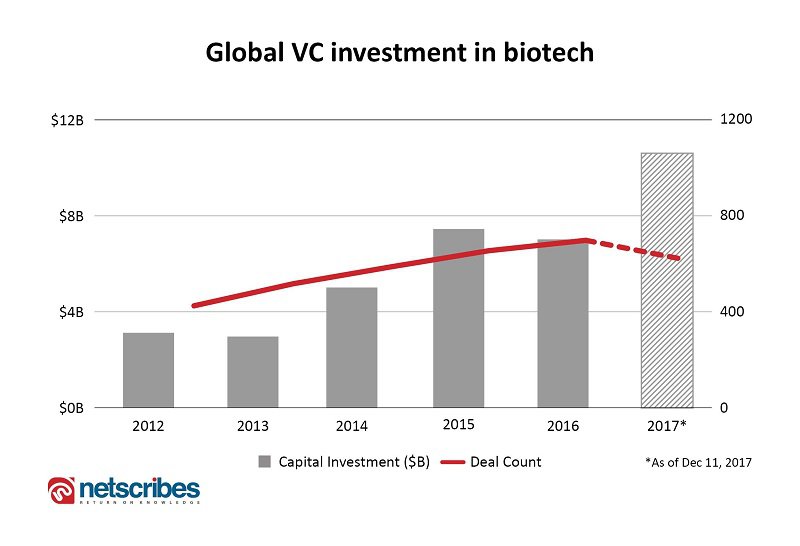

Biotech to the rescue

The biotech sector crossed through the $10 billion mark in 2017, according to Pitchbook data. Much of the money is being funneled in by VCs to help biotech companies get to the human clinical trial phase – a key inflection point for biopharmaceuticals and therapeutics. Europe, however, seems to be at the center of biotech-VC tie-ups. The Paris-based Edmond de Rothschild (EdRip) recently closed an EUR 345 million fund – the BioDiscovery 5 – geared towards investing in preclinical and early clinical stage companies over a four to five-year period.

Source: https://pitchbook.com/news/articles/vc-investment-in-biotech-blasts-through-10b-barrier-in-2017

Interestingly, blockchain is also of great interest to the life sciences vertical. Biotech companies are creating blockchains dedicated to monitoring and recording supply chain activities in relation to manufacturing and excipient providers. Alpha JWC Ventures is leading the charge in this regard, pouring millions into companies specifically working on innovative applications of blockchain in this space.

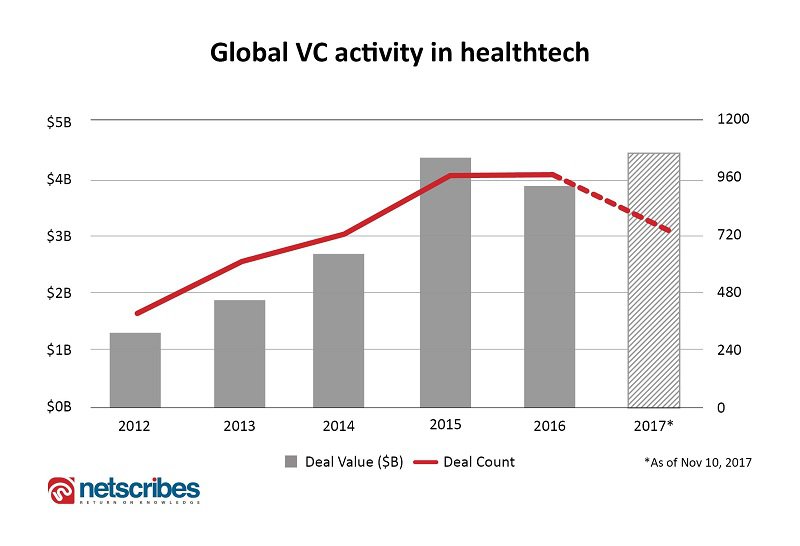

Healthtech is riding high

VCs are funding healthtech companies working on everything from creating robotic microsurgery solutions for cataract removal to developing highly efficient dialysis machines. In fact, Auris Surgical Robots raised over USD 280 million during its fourth investment sequence.

Source: https://pitchbook.com/news/articles/4-trends-in-vc-healthtech-investment

Although biotech firms are destined to get the larger share of EdRip’s funds, a third of it has been earmarked by the VC firm for healthtech and medtech companies. The company backs Autonomic Technologies, a San Francisco-based medical device manufacturer, that has recently been helping the French government and Pulsante underwrite the cost of clinical studies aimed at testing new cluster headache therapies.

While VCs continue to invest in these five key areas, they will also look to diversify into two emerging technologies, namely drones and computer vision systems. As their commercial application potential increases in the coming years, we are likely to see companies offer drones for last mile delivery and image-based quality inspection systems –with VCs helping them get to the market.

For a detailed analysis of the emerging technologies that could impact your business, write to us at info@netscribes.com.