The global electric vehicle charging infrastructure market size was valued at USD 19.26 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 30.6% from 2022 to 2030. Technology advances, a rise in carbon emissions, and an increase in public charging infrastructure have all contributed to the growth of this space.

Both complex and evolving, EV charging infrastructure is a key enabler in increasing the adoption of EVs. To gain a deeper perspective into the dynamics of this niche of the mobility ecosystem here’s an engaging dialogue between Kanv Garg, a renowned thought leader and passionate energy and mobility transition strategist helping OEMs and energy players in defining electrification strategies, and Pranjal Markale, Lead Analyst in the Automotive Insights domain at Netscribes.

Pranjal: Can you please walk us through your journey? It would be interesting.

Kanv: Sure. Pranjal, so as we’ve spoken before, I stumbled upon renewable energy back in 2004-2005, when I joined Evalueserve – a firm quite similar to Netscribes now, right out of my engineering school at NSIT in Delhi. And my entire interest and hearsay, I would say, not passion for renewable energy at that time, was the dream to get into a UN organization.

And somebody, somewhere guided me that if I work on renewable energy because that is the space that will grow, I might get a chance to work at one of the UN organizations. So, it started off with that. Plus, then a lot of work, a lot of interest, and a lot of reading. And that greed of getting into a UN organization turned into passion sometime down the line, which ended up being… when I graduated out of my Business School, which is ISB Hyderabad, I got a chance to work with the Planning Commission with Mr. Montek Singh Ahluwalia’s office, who was the then Deputy Chairman of the apex planning body of the Government of India.

And there, I closely saw how technology, policy and financing worked in tandem with each other in the renewable energy space. And as luck had it, one of the UN organizations, the World Bank Group were a regular visitor at the Planning Commission – the India Energy Team Leader, Ashish Khanna, somehow somewhere saw my passion, interest, and analysis, and they almost hand picked me up from the Planning Commission to work with the Bank. I was then possibly the youngest ever to co-lead a solar investment program at the World Bank, which I very passionately did for more than three years.

And after that, I joined the industry – a couple of startups that did not fare well. Post which, I joined EY. Again, I was lucky enough that EY saw the passion and agreed to offer me an opportunity to develop a revenue-generating business in the renewables space amongst fierce competition from other consulting firms. eMobility was nowhere in the picture as yet. And while I joined EY, I thought about venturing into a new space which was electric mobility and EVs, and coming from an energy side, I thought EV charging infrastructure could be an interesting space. I knew nothing about the space. And as I said, EY was kind enough to give me that space to lead and grow that sector. And by God’s grace, by friends like you and with a lot of, problems in the sector, I gained a lot of hands-on exposure and ended up leading their overall energy-side EV and EV charging work for EY globally.

So, I did that for more than six years in India and the Middle East and after that, I joined a Saudi Arabian automotive company as their director for strategy, for some time to implement a strategy which was built by EY Parthenon itself in the Middle East.

So yes, I started off from renewables and then transitioned into the energy side of electric mobility and EVs, which was the charging infrastructure. And then gained some first principles-based exposure around how charging infrastructure was facing issues or could face issues and what could be some of the mitigation measures and business models around EV charging infrastructure. So, I would hesitate in calling myself an expert. I am just a first principles learner in this space, Pranjal. And here I am in front of you. Thank you for having me.

Pranjal: Well, I thank you for, being here with us. I must say your journey was quite fascinating and exciting.

Kanv: I’m just telling you the good parts about it. There were a lot of challenging parts as well. Especially when you are building the market itself and any new market creation faces criticism and naysayers at every nook and corner.

Pranjal: Ok. So with that, I quickly want to jump to my first question. ICE 2 EV is a paradigm shift and unsustainable in various ways. What do you think, how the future of EVs would be?

Kanv: Let’s forget about a common man who is struggling to make his or her ends meet does not care about climate and sustainability. So, even if I look beyond climate change and sustainability, what I have seen in India and in other parts of the world, is that electric vehicles, by the very virtue of what they are technologically, are a better vehicle to ride. For the individual passenger and for commercial fleets and other form factors of electric vehicles.

And we also see that because the cost of batteries is falling, technologies improving, the range is improving, consumer awareness is improving and it’s a smoother vehicle to drive. The future is definitely electric. If I add on to that, the mandates and the regulations around climate change, sustainability, clean air, and all of that stuff, we will see these supply and demand factors fighting it out together, resulting in an electric future for mobility. Whether you call it battery electric vehicles or hydrogen-powered vehicles, or some other technology might come in. It’s a writing on the wall that the ICE engine or the ICE technology is on its way out. This is how I see it.

Pranjal: Interesting. So, can you put some light on the charging infrastructure and who would be the key stakeholders, and what would be their roles in this?

Kanv: So, before we get into the EV charging infrastructure, let’s just lay out the land – how the eMobility ecosystem is. There are four or five different kinds of eco/sub-ecosystems playing in the broader eMobility ecosystem. For example, one is the hardware side of it. Then, you know, the vehicle itself, the batteries, whatever you can touch, so that is that.

Second. Then comes how you charge that vehicle. The charging infrastructure, the energy coming behind it, the electricity distribution utilities, and all that stuff.

Then comes the software part of it – charging platform systems, and internal platform software, which is around EVs.

And then there are then the peripheral issues of cities, mining, all of that stuff. So, let’s just focus on only the charging infrastructure bit of it. Because of the hardware, a lot of innovation is already happening on the batteries and the vehicle side of eMobility.

But the charging infrastructure is very interesting from that space – that it is one of the most ignored aspects comparatively, in terms of EV growth. While everybody majorly focuses on the vehicles and the battery side of it, the commensurate understanding and deployment of charging infrastructure still remain a challenge. In addition, Interestingly, the deployment of charging infrastructure is the only aspect in the entire eMobility ecosystem that has to be local and require on-the-ground collaboration. Rest, all of the aspects can be globally sourced or not necessarily have to be local.

I’m very surprised that in the market, even today in 2022-23, it is being said or asked that ‘What will come first?’ It’s a chicken or egg situation – whether EV charging or electric vehicles will come first.

While many years back this conundrum has been resolved globally, it’s the charging infrastructure that has to come first. And one of the reasons why charging infrastructure deployment is stunted, not only in India but in other parts of the developed world as well, is because it still lies at the intersection or the helm of shared responsibility between the auto OEMs, who for all the right reasons, only want to sell the vehicle, the real estate provider who wants a commercial return on the space provided for the charging infrastructure, the distribution utility, which actually provides the electricity and will actually need to strengthen the distribution system, and who really doesn’t understand the nuances of EV charging technologies, or sometimes or most of the times, doesn’t have the requisite space.

So, what I’m saying is, while vehicles are pure play coming from the auto OEM, the charging infrastructure still becomes an orphaned baby, which is lying at a shared responsibility between these multiple players – the energy providers, the charge point operators, possibly the charge point OEM, the auto OEMs, and the consumers, and the real estate providers.

Pranjal: Understood. Interesting! You have very well put up with the example of the chicken or egg first. Well, it is quite clear that it is the EV charging infrastructure that has to come first. I heard you mentioning various stakeholders and how the charging infrastructure ecosystem is laid out. So according to you, what would the typical business model of EV charging infrastructure in India be or would evolve like? What would be the typical, revenue flows for EV charger OEMs, and CPOs, and is this business profitable?

Kanv: Sure. So that’s a great question and a very, very pertinent issue in the EV charging ecosystem.

…which is lying at a shared (and in many cases, no one’s) responsibility between these multiple players in the ecosystem. So here comes the role of Mobility Service Providers (MSPs) or Charge Point Operators (CPOs), who can take ownership, ensure the operations & maintenance, and make some kind of a business model for the EV charging infrastructure by functioning at the intersection of all these ecosystem players.

First, let’s talk about what challenges will they face and look to solve. If we say that EV charging infrastructure is a shared responsibility between all these players, and we all know from our management books that shared responsibilities are nobody’s responsibility, these MSPs and CPOs have the challenge that they have to, first of all, integrate and work at the intersection of all these players.

And their challenges are further aggravated by value chain issues such as supply chain disruptions, and product quality issues from the charger OEMs. And we all know with the existing semiconductor glut in the global markets, these chargers are in short supply, not only in India but in other parts of the world as well. And then on top of these hardware issues, there is a myriad of approval processes (and associated delays) right from the homologation process, the actual roll-out of government tenders to put these charging infrastructures, and by the auto OEMs with whose vehicles these charging stations have to be interoperable both on a software and a hardware side.

And then, there are multiple EV charging standards. Before the Bharat standard had come in, you had the CCS, CHADEMO, GB/T, the Tesla standard, which is already operating in the market. And then, of course, there is the access to the capital and financing issue. Charging infrastructure by itself is a high capital expenditure business. So, the challenges are only getting added on for the MSPs and the CPOs who want to make a business model out of it.

And from a demand side, because the number of vehicles in the market is currently low, and we are saying between the chicken or egg, it’s a charging infrastructure that has to come first, so Pranjal you can see, that while these challenges are there and somebody still overcomes them and sets up the charging stations, there will be a low footfall and hence a low return on the deployed EV charging infrastructure.

From this perspective, I see that the business model in EV charging infrastructure is actually extremely challenging. Because, by the very definition of all these challenges, EV charging infrastructure, Pranjal, is not a financially viable business proposition as of now. What, or rather, how I see this market in terms of business models is that I see potential MSPs or CPOs to think across 2 axes – X axis and Y axis. Assume, that I divide my X axis into three portions – free, one-time fixed fee, and recurring fee. I divide my Y axis into three portions again – hardware, the application + charger management system (CMS) & associated fees, and recurring usage.

In this 3 x 3 matrix there are 9 cells that will be formed, and this is where all CPOs and MSPs can see their business model of EV charging coming into play. Some of them might want to give all of this for free from an aggregation perspective. Some of them might be very concerned about the revenue and start demanding revenue for all of these, right from day one.

And some might be saying, OK, we give you software for free, and you give us only a recurring fee. Or we give you the hardware for free, you give us the software and the recurring fee at a certain price. So, business models come like this. This is one way of looking at the business models.

There could be other ways of dissecting the plays and arriving at business models. For example, across the value chain of charging infrastructure. A useful BCG report lays out the distinct plays for charge point operators in the EV charging ecosystem. Below is a figure from this report.

But yes, that does not take away the fact that EV charging infrastructure is not a financially viable business model as of now.

Sorry, I’ll stop here. Take a rain check. Happy to answer more on this.

Pranjal: We want to understand from India’s perspective. So, India has a very ambitious target for electrification by 2030. So by 2030, the country expects its EV sales penetration should reach 30% for passenger cars, 40% for CVs, and 80% for three-wheelers and four-wheelers. So, what do you think is the possible roadmap for this ambitious target? Considering our position in terms of charging infrastructure and people’s anxieties about EVs. What could be the possible roadblocks or challenges and how those can be overcome?

Kanv: Sure. Pranjal, when I started working in this space, because there were several people who guided us, and depending on their learning from other sectors, I also bent to believe that the EVs or the EV charging ecosystem play in India will be different from other countries.

However, now after many years of working in this space and having seen this sector develop in other regions as well, what I realize is that the EV charging ecosystem challenges and the market play are quite similar to what’s happening in other parts of the developed world – say Australia, Europe, the US, and other places.

For example, I give you quite a simple, but profound example, and that’s the crux of the EV charging ecosystem. It’s that the EV charging ecosystem is not a technology or a financing issue. It’s a real estate issue. It is all about finding the most appropriate space, at the best possible commercially favorable rate, and it’s this space ownership aspect that leads to unease or delays in terms of approvals, financing, and asset utilization.

Hence, the charge point operator or the mobility service provider, when they are thinking about business models for their EV charging infrastructure, have to figure out the most appropriate real estate which can come to them from a value versus asset utilization perspective to set up this charging ecosystem.

And for auto OEMs for example. Increasingly, we are seeing globally that auto OEMs can no longer outsource or depend on third parties to give their consumers electric vehicles access to charging infrastructure or free charging somewhere. While they started off with third-party CPOs, Auto OEMs need to control the EV charging experience as well. And Tesla is a prime example of this. Even though they are not in India right now, Tesla controls its own supercharging network in whichever countries they are present. And that undoubtedly leads to better sales of electric vehicles as well.

And this is now what other auto OEMs such as Daimler, and GM are also trying to do. They’re trying to control the EV charging experience. However, they should also understand that while Tesla might also be putting up their EV charging stations, their EV charging stations by themselves are not a financially viable business. It’s marketing or a customer acquisition cost. It’s a way to grow the ecosystem or to increase awareness in terms of crowding in or impacting the buying decision of potential customers for their EVs.

So, possibly a way for auto OEMs could look at the EV charging ecosystem as a marketing expense in their internal accounting. In such a scenario, even when the charging infrastructure is not making money, it is leaning toward lower heartburn for them. It’s a marketing expense for them and hence if it’s not making money, that’s fine. They should be able to sell more electric vehicles because of this and that’s where the profit margins for the auto OEMs will come into the picture.

Then on the national targets for India that you spoke about, the interesting fact here is that in India, there are no official government targets around EV penetration in the recent past. The only government target was to deploy 6 million electric vehicles across form factors by 2020 in the National Electric Mobility Mission Plan (NEMMP), which was launched in 2012.

But as you might have noticed, nobody refers to that national document any longer.

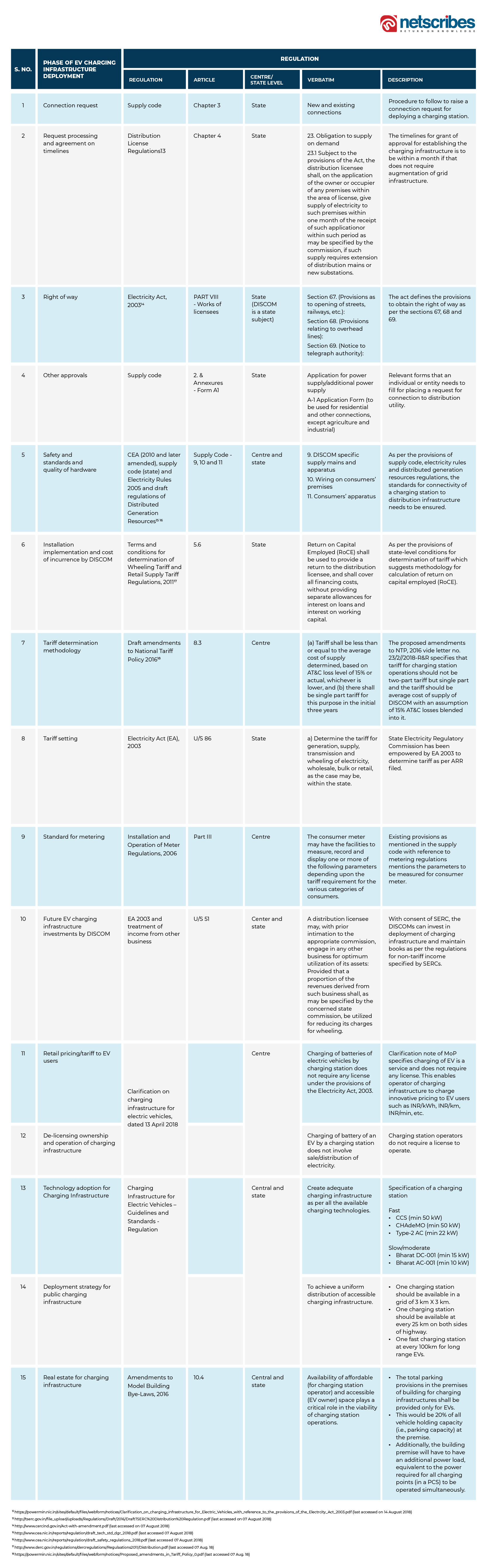

Approvals and regulatory challenges remain the biggest barriers to the uptake of EV charging infrastructure. There are a huge set of approvals and there is a useful report from the Bureau of Energy Efficiency (BEE), Ministry of Power, and I still remember the page number, I think is around page number 37 to 39, which lays down the regulatory framework across 15 steps that are needed for anyone to set-up a public EV charging station in India. Below is a snippet of this regulatory framework.

While we talk about this, that is on the business model and the challenges, we also have to understand that the majority of charging, both in India and globally, will be home or destination charging. You will always charge when you park your vehicle, not park when you charge your vehicle. And this is an important paradigm to remember.

Plus, as the battery technology and energy density of batteries are constantly improving, it will give a higher range to the same capacity of EV battery. The potential customers are fast realizing this. And if you put these facts together, the need for isolated public charging stations in urban set-ups will actually fade away.

Only natural destinations or pit stops, such as offices, malls, and hotels, will need to have public charging for private vehicles. Yes, for commercial vehicles, their hubs or centers which have the delivery load, upload, and other spaces for vehicle maintenance, will have the charging plugs both for operational ease and for commercial reasons.

And this is what we are seeing in other parts of the world as well. Home and destination charging will contribute to around 85% to 90% of the total charging sessions. But having said that, because public chargers needed will be fast chargers, they will be the higher capacity and more expensive chargers – their deployment will require public funding support, in addition to lowering or removal of regulatory and approval challenges.

Again, I’ll stop here. Take a rain check.

Pranjal: Yes, thank you so much. You discussed the role of OEM share, how they should come into the game, and that will eventually push the growth of the charging infrastructure. So, apart from OEMs, what do you think, who would be the key stakeholders? As you mentioned, the real estate guys should pitch in. Apart from these players, who would be the other key stakeholders who can push the growth?

Kanv: Sure. See, whether we like it or not, I’m quite convinced that real estate or access to appropriate real estate is the biggest issue in terms of public EV charging infrastructure growth. Now, having said this, people who have access to that real estate, whether it is the government or the municipalities, or the commercial real estate owners, will continue to be key stakeholders in the deployment of public EV charging infrastructure.

That is why I’m saying that the CPOs or the mobility service providers if they have to successfully get into and run the EV charging infrastructure business, should have the operational muscle to pull together the real estate providers and stitch together collaboration and contracts between these multiple parties involved.

Pure play charging infrastructure deployment companies, who have no relationships or the operational muscle or access to real estate might set up some charging stations now and grow to a certain level. But they will eventually fade away or consolidate or merge with the mobility service providers. So, how I see this in the market, is that our market will move from a heterogeneous market, which means a large number of charge point operators having a small number of charging stations on their platform, right now to a more homogeneous market in the future.

A homogeneous market means there will be a small number of charge point operators having a large number of charging stations on their platform. So, absolutely the companies who have access to the real estate or a natural location advantage or who have the aggregation power to themselves will be the ones who will control this market, from a mid to long-term perspective.

Pranjal: Understood. Interesting! So, we have right now touched upon the availability aspect.

If you can just put up the charging duration aspect of it, as it relates to the range anxieties… So how is that viable, because the solution to it is fast charging only? And if you see from the cost perspective, the fast charges – the DC charges are quite expensive than AC chargers. Also, if you can put some more light on the business viability of this?

Kanv: Sure. See Pranjal, your home charging will be the only kind of charging that can be slow charging. There, you naturally park your vehicle for many hours and a trickle charge or a slow charge can charge your vehicle over many hours (say, overnight). If you are charging your vehicle apart from home charging anywhere, it will be fast charging for that vehicle time.

Now, we have to see that a charger, which could be a slow charger for a three-wheeler or a four-wheeler can actually be a fast charger for a smaller vehicle. So, it is very, very important for CPOs to understand this fact, that rather than going in a rat race to put up specific types of charges somewhere, transport studies and vehicle flow should be done on any network before deciding what kind of charging stations you’re putting in. You might be putting in fast charges somewhere, which are very expensive. But if the majority of traffic movement or getting parked there is two-wheelers and three-wheelers, your fast charger for a four-wheeler will be a waste of money.

And that is the kind of assessment that is not being done, both by the government and by the private sector together. And this is what I’ve been seeing repeatedly over years, not only in India but in other parts of the world as well.

So, what I’m saying is if it’s a public charger, it has to be a fast charger for that vehicle type. Only the home charger will be a slow charger. And generally, we have seen, if we see the cost and revenue levers around charging infrastructure, any public charging station takes about 6 to 8 years to break even if they have access to real estate given current vehicle types and the possible footfalls of electric vehicles.

Pranjal: Understood. That’s very thought-provoking. So, I would like to extend my question to the interoperability of the EV chargers.

There are many charging standards like type 1, and type 2 existing in the market which can possibly confuse the customer before buying EVs. And this goes with the software as well. Do you think there should be a government policy that would define the standardization of EV charger types and software?

Kanv: Sure. So that’s a very good question, Pranjal, and complete interoperability in terms of software and hardware is the bedrock and is critical for EV charging growth in India and in any other part of the world. Now, this is where you know it gets even more interesting.

While we say that EV charging infrastructure is not a financially viable business because of the low footfall and high Capex and everything, this is where the government also has to step in, in terms of public money or interventions to give a subordinated loan or a viability gap funding or some mandates to the distribution utilities to set up EV charging infrastructure.

This means if the government has a hand in giving financing for EV charging infrastructure, they also have the power or the mandate to make it interoperable. They can give mandates to the CPOs or the mobility service providers that they will get the government funds only if they’re charging infrastructure is 100% interoperable both on a hardware and software basis. So, this is where you know, a challenge can be, or rather two of the challenges – interoperability and financing can be shot down by one single stone.

And, even on the private sector side. Let me give you an example of highway charging. What I have seen in my experience is that while everybody’s focused on urban environments, home charging, public charging, destination charging, highway charging, which is the high-speed highway charging between two cities on highways in a large country like India, is actually a further orphaned baby in terms of the EV charging infrastructure spaces. And why this is a bigger challenge, is because these high-speed chargers are even more expensive. And they will have even lesser footfall. So, the financial viability of highway charging will be even worse.

So, for consumers, you might have heard this – that anybody who has to buy an electric vehicle always says. “Okay, I can buy an electric vehicle. But what about that once in a year when I need to go to Jaipur from Delhi or to Chandigarh from Delhi, how would I charge my vehicle at that point in time?”

This means highway charging is extremely important from a consumer awareness and consumer satisfaction around the EV technology point of view. Now here the idea is that we can take inspiration from the Ionity model in Europe where the top 5 auto OEMs have come together to set up a pan-European, interoperable high-speed charging network.

For example, in India, Hyundai Motors, MG Motors, Tata Motors, Mahindra, and possibly Maruti Suzuki – can all come together, pool in funds, and set up a high-speed, truly interoperable high-speed charging infrastructure network across highways in the country. This will be done in partnership with a possible utility and say, Power Grid Corporation of India Limited (PGCIL).

What this will lead to is sharing of costs, promotion of interoperability, reduction of consumer doubts on the technology, and more charging confidence.

So again, I’ll take a rain check here if I could answer your question.

Pranjal: Sure. My next question was how an OEM should align its product valuation. But you have already answered that. So that’s interesting. So, now going forward, what types of technological advancements can we see in the EV charging space? Like a typical business model, if you can think of right now or in the future for the Indian charging infrastructure industry?

Kanv: See, again from a first principles basis, when I’m saying charging infrastructure has challenges on the business viability, this means we have to look at levers to increase the revenue. And look at levers to reduce the cost.

Now, the cost can only be reduced from a scale and a policy perspective. If there is a policy clarity from the government that OK, only these types of charges will be put in – the charger OEMs and the other players in the market can look at the scale to only produce those kinds of chargers. And localization will happen in the market – in a country like India, and that can be a lever to reduce the cost.

On the revenue side, if there is a lower footfall of electric vehicles – now that is a problem for the auto OEMs to be solved. But a charging infrastructure player can actually look at levers like combining your charging station with, say, a vending machine or, you know, these kinds of revenue enhancement levers.

Or some years or some months down the line, if the regulations are in place, V2G elements can be put in – where you can look at pumping electricity back to the grid and getting some revenue from the distribution utilities such as you to do in the net metering space for the solar sector. So, these are two spaces that come to my mind in terms of improving the financial viability and looking at a business model for public charging infrastructure.

Pranjal: Understood. So, at last, I want to understand, since we have recently discovered lithium reserves in Jammu and Kashmir, will this boost the EV ecosystem?

Kanv: See again, from whatever we have read in the media, you know these reserves are still at a G3 level and they’re still to be proven. Plus, the development of mines takes about 8 to 10 years to come into place. So, in the short to medium term, given our dependence on the global supply chain for lithium and other raw materials, I don’t see that it will go away.

Yes, but such news will definitely give a boost to the domestic electric vehicle industry. And hence I think, the cost of batteries is slated to come down, which will lead to the overall cost of vehicles coming down. So, I do see EV charging infrastructure growing.

There is no doubt about it, whether we had or had not found lithium in our country. You know, as I said to your first question, the future is electric. And the future is electric means your charging infrastructure will need to grow. But yes, the players operating in this industry are still to find their equilibrium, in terms of understanding the fundamentals and that the financial returns on charging infrastructure will continue to be challenging. And hence, they have to choose the right partners in terms of real estate and locations to set up their charging infrastructure and look at additional revenue-generating levers to step up financial viability in this space.

Kanv Garg

ex-Strategy Director, Petromin Corporation Jeddah, Saudi Arabia

Kanv Garg is a well-recognized clean energy and mobility sector evangelist, industry speaker, and a trusted advisor to a variety of organizations - national and sub-national Government entities, International Funding Institutions (IFIs), leading industrial conglomerates, energy players, auto OEMs, non-for-profits, start-ups, and leading funds. He is the ex-Director of Corporate Strategy, New Mobility Business for the Petromin Corporation, based out of Jeddah (Kingdom of Saudi Arabia (KSA). Prior to this, Kanv was the eMobility Energy Lead for EY Parthenon in the Middle East, and the eMobility Energy Lead for EY in India. He has also spent impactful and market-creating stints in the solar sector with the World Bank Group, the Planning Commission of India, and Evalueserve. Kanv has more than 17 years of experience in the ever-evolving cross-section of energy and mobility sectors, addressing CXOs challenges on strategy & implementation, program design, investments, and partnerships & collaboration. Kanv is an MBA from the Indian School of Business, Hyderabad, and Bachelor of Engineering from Netaji Subhas Institute of Technology, New Delhi.