What products should I keep, carry, or drop from my existing assortment? This is a persistent question on the minds of not just category managers at physical stores but e-commerce ones as well. Every seasoned e-commerce player is constantly refining their assortment and needs constant optimization to hold customers’ attention and control the costs of inventory and logistics. Deliberating on the product mix, depth, and width, accounting for potential cannibalization by certain SKUs, managing the availability or absence of alternative products, and more, are aspects that keep category and assortment managers always on their toes.

Assortment inefficiencies can lead to substantial losses, especially in the CPG sector. In fact, in Western Europe over 70% of all sales come from 2% of SKUs and of the 120 new products launched onto the European market every day, with only 30% survive past two years. To put it simply, 98% of SKUs and 70% of new products are simply a drain on resources, finances, and brand perception.

To draw a timely perspective on the indispensable role of assortment optimization in the post-COVID market, and how brands, retailers, and marketplaces can stay competitively grounded, we asked Chaitanya Gadiyar, Associate Vice President of Technology and E-commerce solutions at Netscribes to share his views.

1. Assortment management in retail has always been around. What novelty does the intelligence factor bring to the table?

Until lately, conventional approaches to product assortment included the analysis of third-party market share data, long-held practices, and anecdotal supplier-based recommendations. Gaining competitive and timely insights was a challenge as relevant data was either hard to assimilate and analyze, or rarely available in an objective and systematic manner. This left assortment planners to distill cues from historical evidence and combine it with their intuition, often ending in scrambled assortment decisions.

But now, with data-driven, AI-enabled assortment optimization, e-commerce firms can weigh in on a multi-faceted product view for everything from inventory stocks to competitor analysis. It helps better assess product bundling and audience segmentation and enables an understanding of customer preference and alternate product viability. With it, category managers can identify under or over-represented categories, profitable categories, and the best way to calibrate each category portfolio for maximum sales. In the digital economy, we live in this is a definite edge players invested in assortment intelligence solutions have over their rivals.

2. What can retailers do to have a constant pulse of their assortment’s relevance?

For any retailer, catering to the widest range of consumers while ensuring minimal wastage from overstocking is crucial. This demands continuous benchmarking of your assortment against that of your competitor. Let me give you an example. One of our clients, a retailer selling fragrances in the UAE wanted insights on the SKUs housed by its competitors on a weekly basis.

Timely insights from our interactive assortment intelligence dashboard helped them identify overlaps in the SKUs they carried, as well as gaps in their own catalog. This enabled them to harness the opportunity of catering to a whole new segment of customers, among other data-driven assortment decisions. Our automated solution encompasses everything from price points to multiple brands and more, for accurate assortment tracking.

Get a glimpse of our interactive dashboard live in action

3. How does AI ensure precision in assortment optimization?

Studies show that by the end of 2025, all global multichannel fashion retailers will use AI and automation to create more targeted assortments, reducing item choices by up to 30%. A variety of factors are considered by AI algorithms, including past sales, store display space, local trends, online behavior, expected weather patterns, and more, to figure out what products fit best in a particular location.

Not just that – AI-based optimization helps prevent stockouts by routing more inventory to stores where products are needed most. For retailers, this helps minimize markdowns by ensuring that products are on display where they can be sold at full price. To take advantage of local trends, AI models can do things like reroute inventory between stores and/or update product pricing at scale. When category and commercial managers have AI-driven insights like these at their fingertips, they can make intelligent assortment decisions that will add real value.

4. How is the post-COVID consumer behavior impacting assortment decisions? Do you have any recommendations?

Once you expose consumers to a new level of convenience, lower price, or better fit, their expectations will be set there at a minimum moving forward. For instance, in New York online grocery spending grew faster than offline spending after the pandemic, regardless of retailer type. Even marketplaces like Amazon are curating online assortments that come from TikTok best sellers. So, understanding what new and innovative products are out there and what benefits they bring as per shoppers are cues retailers can use when identifying their assortment.

With lockdowns being lifted, we all know that there’s bound to be a reset in consumer behavior, point of sale, and basket, to say the least. Yet, rather than taking a reactive approach, e-commerce players would do well to begin rolling with the learnings gathered over the past couple of years. In my opinion, as we venture into this new normal, players who start working on their assortments early on, will have the advantage of being industry trendsetters and better equipped to optimize their products mix ahead of their competitors.

5. On a separate note, how much do you think can inconsistent branding influence a business’ e-commerce growth?

I’m glad you asked the question. The truth is, on the physical store level, brands tend to spend millions on advertising and ensuring appropriate product placements and adherence to brand guidelines through dedicated area managers across various store formats. However, when it comes to digital marketplaces online marketplaces, product titles, descriptions, and pricing are usually sourced from sellers and may not be consistent across sources.

So even if your assortment is optimized for the right audience and based on current market trends, it could be underperforming because customers are not able to find a particular brand or are having trouble trusting what meets the eye. Such instances can cause lasting hindrances to your sales growth.

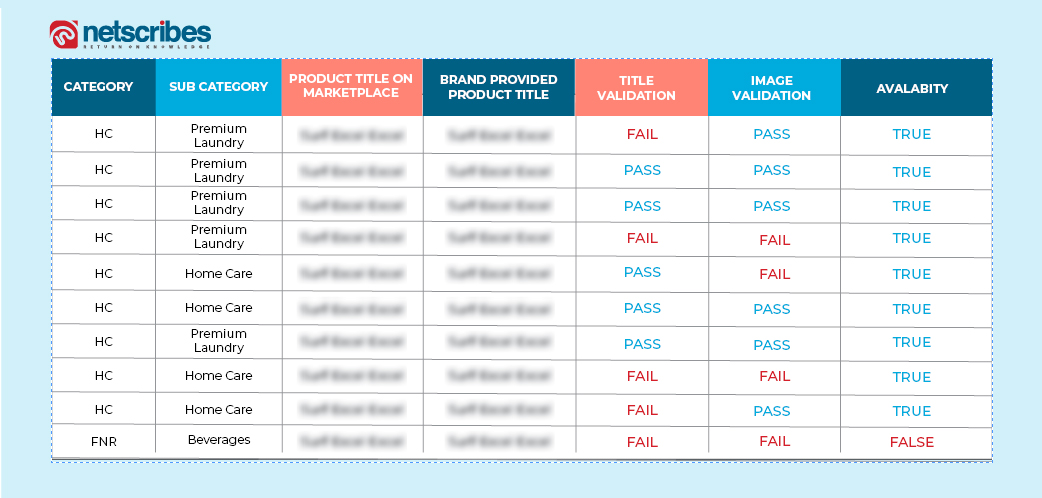

Therefore, it becomes imperative for brands to proactively track key product attributes to ensure that brand value is not diluted. And this is something Netscribes helps achieve. Monitoring and tracking brand guidelines on a large scale, our platform compares product titles and images across marketplaces against the ones provided by client brands to uncover misrepresentations that can be rectified.

The purpose of assortment optimization extends far beyond revenue maximization. It offers a barometer of customer satisfaction. And this is crucial because at the end of the day you want people to keep coming back to your store because they can find what they need.

Over the past couple of decades, Netscribes has been equipping leading brands and some of the largest retailers and marketplaces across the globe with in-depth, competitive insights and technology solutions to adapt to the latest developments in e-commerce. From assortment optimization to pricing intelligence and more, to find out how we can help improve your digital shelf to look its customer and sales best, contact us.

Chaitanya Gadiyar

AVP of Technology and E-commerce solutions, Netscribes

Chaitanya oversees MarTech managed services, E-commerce platform development, and Public data intelligence solutions at Netscribes. When not taking care of his 8-month-old son, you will find him immersed in his Spotify playlists, watching NBA games and F1 races, or tracking the capital markets.