The consumer healthcare sector has witnessed a steady rise over the past few years. This stems mainly from rising healthcare costs, and more recently, increased pressure on healthcare staff amid the pandemic. As a result, more people are taking their health into their own hands by turning to preventative care and non-prescription treatment for minor illnesses.

A study by GSK and Ipsos found that 65% of Europeans are now more likely to pay attention to their health than they did before the pandemic. A significant proportion of the population across Europe consider it their responsibility to relieve pressure on healthcare systems.

As current market forces propel consumer healthcare into the limelight, we take a closer look at the trends in this space.

1. Accelerated demand for OTC products

The COVID-19 pandemic has resulted in significant demand growth for over-the-counter (OTC) medicines, especially for illnesses such as cough and cold. The global OTC market was worth USD 202.26B in 2020 and is forecasted to grow at a CAGR of 8.23% over the next five years.

With healthcare providers (HCPs) prescribing OTC drugs, patients are becoming less dependent on prescriptions. According to a survey by PwC, months after the pandemic hit the US, 52% of consumers who take medication regularly were concerned about obtaining prescriptions when they needed them, while 17% experienced delays. This signals the need to consider OTC options when patients get sick.

The industry is also being pushed forward by increased attempts to license OTC medications for the treatment of cough, cold, and flu. Furthermore, the vitamins and dietary supplements (VDS) segment is projected to expand rapidly over the next five years as a result of the growing prevalence of these products in developing countries due to an aging population.

2. CBD products witnessing growth

Cannabidiol (CBD) products have grown in popularity since their legalization in the US under the 2018 Farm Bill. The global cannabidiol market was worth USD 2.8 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of 21.2% between 2021 and 2028. According to a study, CBD products are now common to 64% of Americans. As a result of the challenges and uncertainty that people faced in 2020, there has been a steady increase in CBD use, especially for stress management and pain relief.

However, often due to unclear regulations, certain retailers who carry various segments of the CBD market, end up restricting their supply. For example, scores of mainstream retailers have now offer CBD topicals such as hand and body creams, balms, and cosmetics, but most have been reluctant to market ingestible goods until the FDA provides more regulatory clarification.

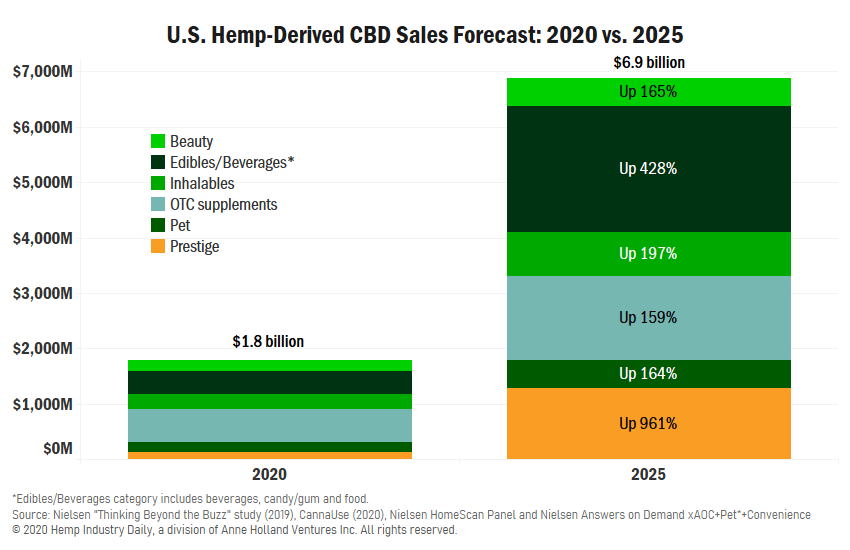

Further federal legislation in 2021 will enable the retail CBD market to expand. The FDA’s budget proposal for 2021 includes USD 5M for the regulation of cannabis and its products, demonstrating the willingness to press ahead with its testing and approvals. If CBD edibles and drinks are better regulated, sales could increase by 428% by 2025, compared to 159 percent growth for OTC supplements.

Source: Hemp Industry Daily

Although manufacturers have been focusing on making CBD a certified food product, according to a Nielsen study, the food sector is one of the smaller CBD categories. On the other hand, the premium CBD segment, which comprises cosmetics and skincare brands, usually available at high-end stores, may provide more potential, with sales projected to grow by nearly 1,000% over the next five years.

3. The proliferation of digital health

Digital health products and services have been a blessing during the pandemic. For patients who are hesitant to visit clinics physically, digital health technologies, such as telehealth services and health trackers, have made it easier to receive timely medical attention.

The pandemic has accelerated consumer activation for digital health platforms. Consumers have expanded their interactive experiences and experiences with health apps since March 2020, and they are now more likely to share their private data. Data from wearables can help deliver customized care to consumers when specific readings are made and used by the devices to return useful information to the user.

Aging populations, for example, can use such tools to track facets of their health such as heart rate and temperature. Similarly, smartwatches are now also being used to monitor Covid-19 symptoms and assist users in understanding the next steps for testing and prevention. After understanding their present state of health, people can inquire for assistance and get input on the next steps using AI-enabled voice recognition technologies such as Alexa and other digital assistants.

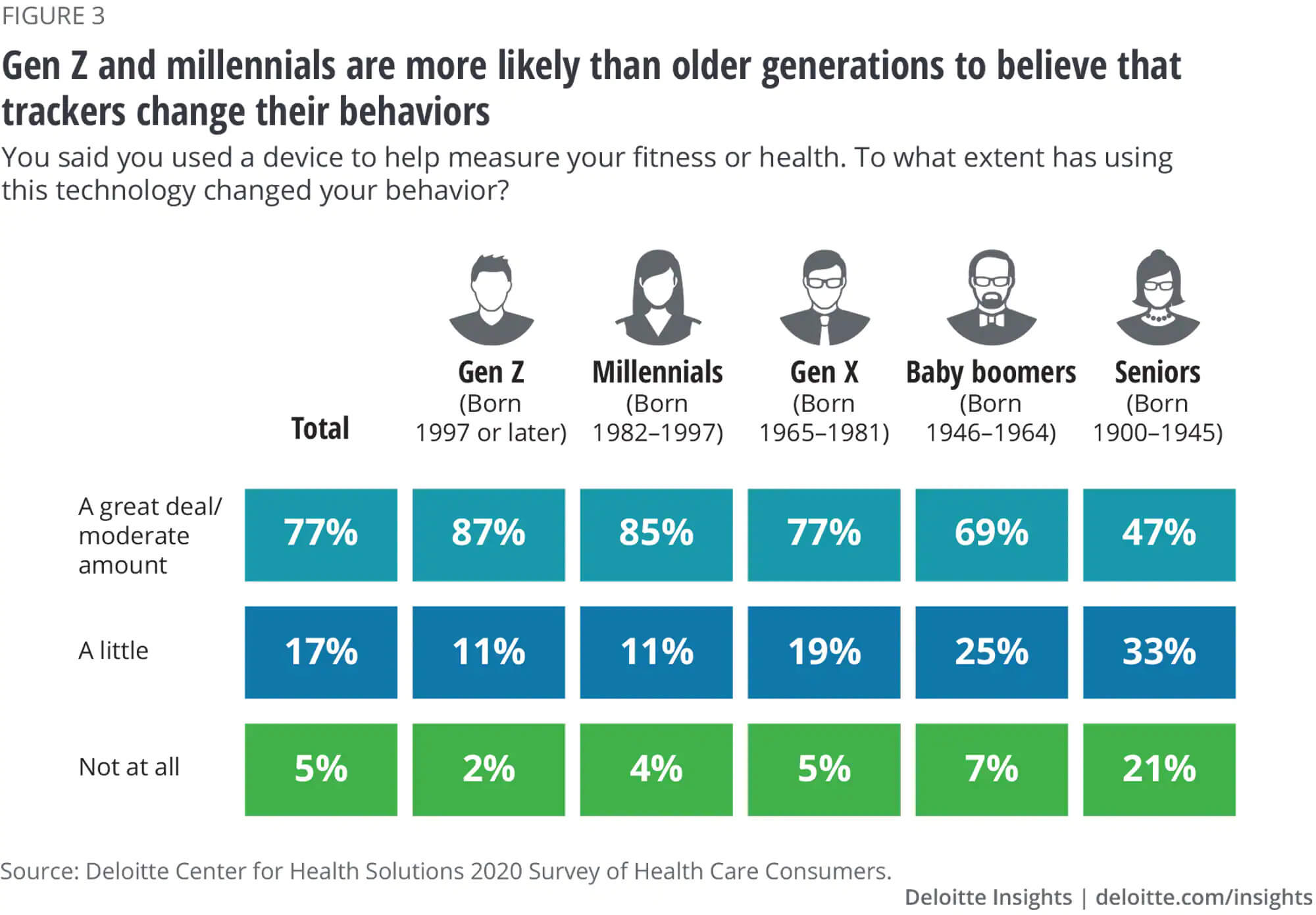

AI algorithms can help determine the right time to alert patients to take medicine, increasing adherence. They can also assist patients with follow-up and insurance concerns. According to a Deloitte survey, 77% of people who track their health digitally, said it affects their behavior at least moderately.

Source: Deloitte

In 2020, more than 2,314B gigabytes of health data were produced, demonstrating the effect that digital health tools can have on the CHC industry. Traditional CHC firms must ensure that they remain on par with competitors, in terms of acquiring specific consumer data and making it usable in a manner that is meaningful to customers.

4. Spotlight on self-care and wellness

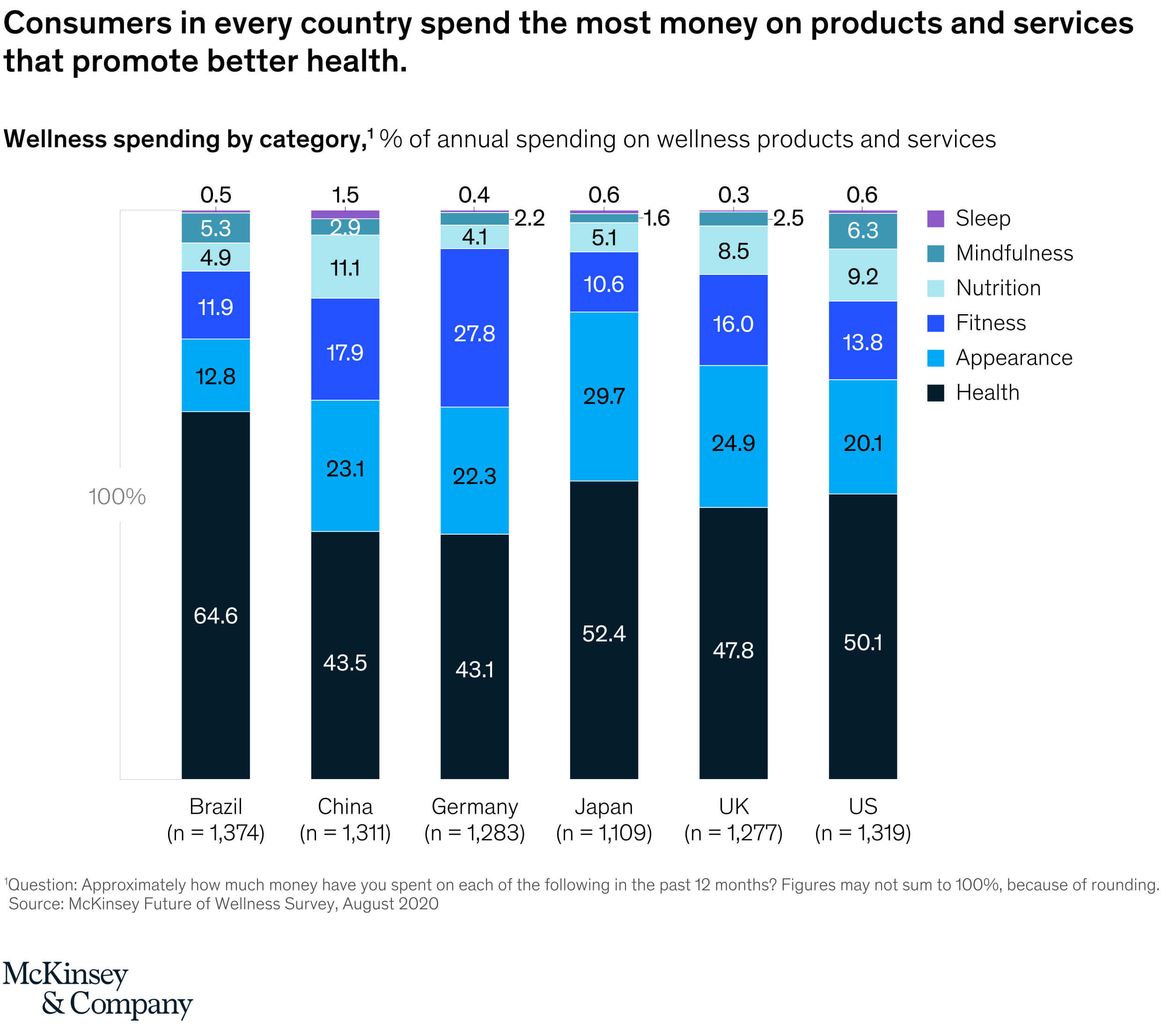

Leading up to the pandemic, healthcare systems were still straining under the pressure of aging populations and increasingly expensive new drugs. A focus on disease prevention and health self-management was long overdue. However, the advent of COVID-19 has given a much-needed boost to the trend of wellness and self-care. Among 7,500 consumers in six countries, 79% agree that wellness is important, and 42% consider it a top priority, as per a Mckinsey study.

Source: Mckinsey

Another survey conducted in the summer of 2020 across Germany, Italy, Spain, and the UK, revealed that 65% of people are now more likely to include their wellness in day-to-day decision-making, and up to 80% will engage in self-care to ease pressure on overwhelmed healthcare systems.

Part of this self-care trend also includes the increased usage of dietary supplements, which are now part of the everyday routine for about three-quarters of US consumers. According to the Nutrition Business Journal, the global demand for VDS goods is projected to reach USD 57B by 2021, doubling in the last ten years.

Consumers are also looking for a personalized experience when it comes to such products. AI will also contribute to the development of this movement by speeding R&D with more specific results, resulting in customized health and wellness goods for consumers. AI is augmenting R&D, streamlining, and speeding up conventional market research and analysis methods. This is critical for health and wellness research as companies hunt for the next major plant-based product or superfood.

For instance, food science startup Journey Foods created the JourneyAI app, which employs machine learning to classify and index promising, under-utilized ingredients and bioactive compounds derived from seeds, aquatic greens, and other non-animal substances.

5. Increased focus on mental health resources

The COVID-19 pandemic has fueled a mental health crisis resulting from social, political, and economic turmoil, as well as a prolonged period of physical distancing. According to a new study conducted by Mental Health America, almost 100K Americans have experienced anxiety or depression as a result of the COVID-19 crisis.

The WHO, and the CDC in the US, and the NHS in the UK, among others, have all issued guidelines to help combat the surge of mental illness exacerbated by the pandemic. To meet their target audiences, CHC marketers have supported mental health services and normalized mental health discussions on social media channels.

To reach their potential audiences, CHC companies have also encouraged mental health services and the normalization of mental health interactions on social media platforms. On the other hand, these companies have also begun launching OTC drugs with a ‘stress relief’ or ‘calming’ claim.

For instance, Nature’s Bounty has introduced ‘Anxiety and Stress Relief,’ tablets which contain L-theanine to “protect the brain’s mood center and foster a relaxed state of mind,” as well as ashwagandha, which is said to encourage a positive reaction to occasional tension and anxiety. Some other examples include, ‘De-stress + Sleep’ by ZzzQuil, which uses melatonin and ashwagandha to ‘manage stress and relax the mind,’ and Olly’s ‘Goodbye Stress’ and Hum Nutrition’s ‘Big Chill.’

While in-person clinical and psychiatric services have been scarce due to the pandemic, consumers and patients can also benefit from creative healthcare delivery models. A noteworthy campaign in the US is a pilot project between the National Council on Behavioral Health, the American Pharmacists Association, and Walgreens to educate pharmacy workers in mental health first aid. The initiative seeks to improve mental health outcomes and will take the pharmacist’s position as a healthcare provider to new heights.

On another note, new technology and digital behavioral health applications will also help to improve mental health, going forward. While 2020 was a standout year for this segment, with firms recording over USD 1.6B in funding, there’s still plenty of room for growth. The accelerated usage of these platforms will provide a critical avenue to not only sustain mental and behavioral health services but also to expand them beyond the pandemic timeline.

6. Rise of e-commerce in consumer healthcare

For consumer healthcare companies, new digital opportunities across the entire value chain, such as expanding e-commerce channels, have opened up new avenues for reaching new customer groups and strengthening existing ones. CHC products have been seeing higher purchasing rates across e-commerce channels as digital health and medicine website traffic and online orders have risen significantly.

As the market continues to move towards engaging with consumers online and consumers continue to access advice and guidance from digital media, it is no wonder that consumers can now also take the final step – actively purchasing a product or service – without needing to visit a physical store.

While major pharmacy retailers have now implemented omnichannel retailing initiatives, merging their physical and online retailing channels to provide consumers with more options, they are now rapidly being disrupted by e-commerce platforms. Benefits of shopping on these platforms include home delivery, a greater product range, potentially cheaper costs due to lower overheads related to physical stores, and relief from drug store pressure.

For instance, accelerated usage of online platforms such as Amazon also provides tremendous opportunities for CHC product manufacturers to market their goods in a virtual shopping mall environment while delivering directly to customers. Even though Amazon does not directly distribute and ship a commodity, third-party wholesalers provide a lucrative way to access customers through the web’s largest retailers.

As more self-diagnosis and consumer engagement in healthcare initiatives are fueled, in large part, by the internet and social media, CHC companies must adapt digitally powered operating models to engage web-savvy customers who demand a consistent experience across all platforms.

A look ahead

COVID-19 has altered several consumer healthcare preferences and behaviors. To flourish in the ‘new normal,’ B2C healthcare firms will need to reinvent how they engage their customers and market their goods and services both directly and across clinician networks. Currently, actions such as educating consumers, reviewing product portfolios, rethinking channel strategies, and enhancing marketing capabilities, are more critical.

Netscribes helps consumer healthcare companies by providing reliable information and insights across markets, consumers, competitors, and technologies, using a unique combination of social media analytics, primary and secondary research, and IP analysis. To know more, contact us.