Crisis makes you stronger. Forced to adapt to the transformation wrought by the global crisis at breakneck speed, companies across sectors redoubled their efforts, built digital capabilities, and changed ways of working. The banking sector too, in its recovery post-covid-19, is still adjusting to the realities of this new normal across the global economy. COVID-19 has changed the way people bank. The onset of the pandemic saw repeated phases of high stress on the financial markets. Today, processes are digital. Aspects that earlier required manual intervention has now been taken over by renewed digitization capabilities which come with their own set of risks.

Today as banks increase their customer and client-friendly offerings, develop innovative schemes and adapt to the changes posed by the ongoing crisis, they are slowly and steadily gaining momentum on the road to post-COVID recovery. So what’s next? We highlight 6 key trends shaping the future of the banking industry.

1. Rethinking cost reduction strategies and increasing profitability

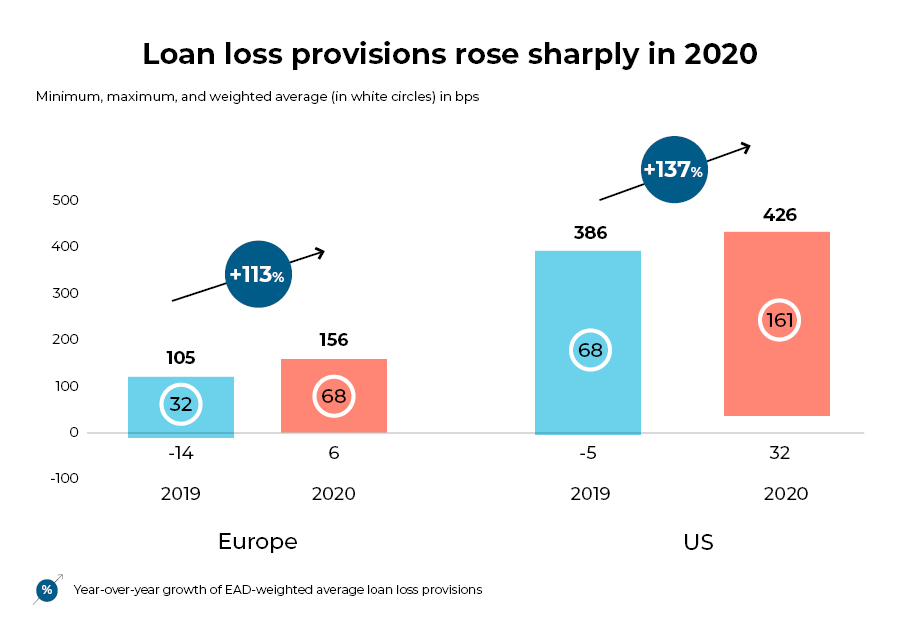

Rising levels of unemployment prompted by the economic shutdown and increasing costs of essential services like healthcare have led to rising defaults and a noticeable surge in loan and debt restructuring requests.

Credit risks and losses: Financial situations of individuals, SMEs, and firms across sectors have not been the best in the last two years. In fact, in the US, consumer debt reached close to USD 15 trillion in 2020 – the sharpest growth in decades. This has led banks to boost economic activities and investments with record low interest rates and ease controls on debt repayments. Lowered values of bonds and other traded financial instruments have also led to increased losses. This has further reduced profitability, increased credit risks, and negatively impacted their margins, thereby creating a liquidity crunch for banks.

Source: BCG

To tackle the decline in profitability arising from lowered interest rates, financial institutions are often adopting commission-based income from tech businesses.

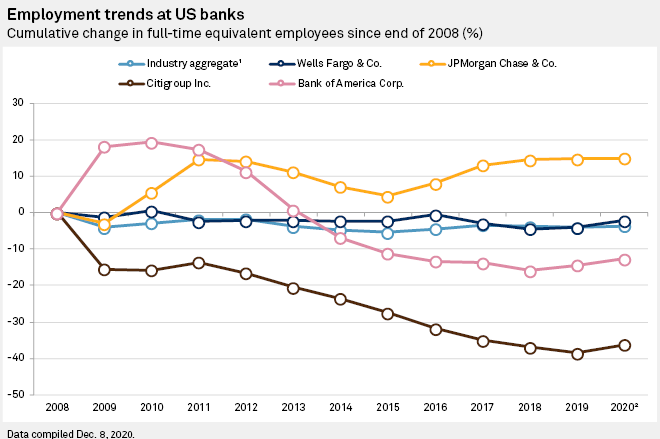

Cost-reduction strategies: To combat the emerging losses, banks are turning to cost-cutting strategies reexamining their branch footprint and workforce efficiency. In fact, 66% of respondents in Deloitte’s survey of B&CM executives indicate an increased likelihood of undertaking cost reduction initiatives, up from 35% before the pandemic. The past year has seen a 5% decline in salary and benefit expenses by US banks. An increase in non-interest expenses has led to lowered efficiency rates prompting many banks to turn to aggressive cost-cutting measures. For instance, Wells Fargo & Co. revealed their 4-year expense reduction plan aimed to bring down annual expenses by over USD 8 billion. Their savings plan involved eliminating layers in management, making workforce and branch cuts, and reducing up to 20% of office space by the end of 2024.

2. Accelerated digitization and innovation capabilities

More than 71% of global consumers are now utilizing digital banking channels on a weekly basis. The pandemic has driven banks to accelerate their digital transformation and implement innovative programs. From ‘nice-to-have,’ to ‘must-have’, AI and data analytics have now become the key focus areas for investments. In fact, over 75% of financial institutions are looking to implement these tools. Banking recovery post-COVID-19 sees firms use these technologies beyond merely monitoring transactions to incorporate more interactive processes.

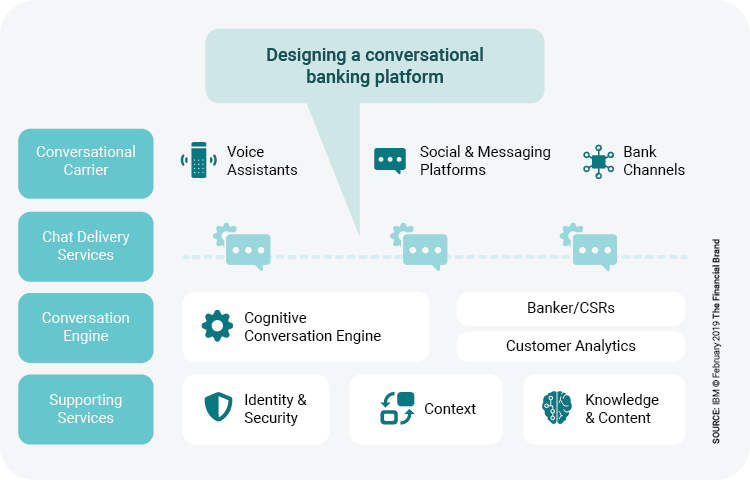

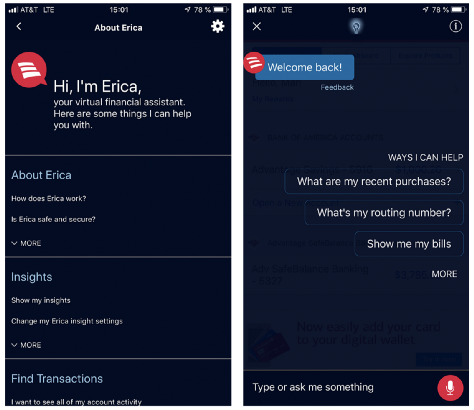

Conversational Banking: With banks shifting their focus from product-centric to consumer-centric approaches, conversational banking is becoming increasingly popular. Chatbots, voice assistants, live-chat with virtual assistants, and visual engagement tools integrated into banking websites and mobile apps are considerably enabling an understanding of consumer needs and enhancing the customer experience with personalized services.

For instance, with over 6,00,000 users, Bank of America’s virtual financial assistant, ‘Erica’ handles several customer service queries like providing credit report updates and balance information, sending notifications, facilitating bill payments, and sharing money-saving tips.

Advanced AI, ML, and digital analytics: Technological innovations like implementing robotic solutions, advanced BOTs to support tech adoption processes, platforms for operations management like system authorization, can play a crucial role in ensuring data protection and business continuity of banks even in the absence of human work staff. In the foreseeable future, branches might even operate more like service lounges. Instead of rows of tellers handling daily transactions, agents can personally guide customers through transactions on their own devices.

One recent example comes from the global giant, HSBC. Taking their digital capabilities up a notch, they not only implemented intelligent automation to set up conversational banking processes two years ago but also recently incorporated AI and ML capabilities to ease their employees’ call burden. The massive volume of their business meant more than thousands of calls across the globe to internal policy experts every year for finalizing risk management decisions. To avoid roadblocks like time-zone delays and ensure consistency and quality in responses, HSBC decided to implement an internal chatbot– a conversational platform to address queries at a large scale ensuring organizational efficiency.

The risk? While increased automation has undoubtedly improved operational resilience, it might also reduce job creation and curb employment opportunities going forward. With large banks increasing investments in digital banking and additional technologies in the road to recovery post-covid-19, research analysts forecast that over 100,000 positions could disappear in the US alone in the next five years.

3. Increasing partnerships with FinTechs

The rise of the digital ecosystem has led to unique collaborative opportunities. In 2019, global customer adoption of fintech services increased to 64%. The partnership allows banks to take advantage of fintechs’ technological advancements while gaining higher levels of trust, capital, and an established base of clients. When platform-based, these business models can also help drive seamless customer experiences.

For instance, leading fintech company PayPal invested in the popular Swedish open banking platform Tink to collaboratively expand open banking technology and offer seamless user experiences across Europe. Barclays got ahead in its appeal to next-generation sustainable bankers by investing in fintech startup Flux that issues digital receipts. When the Bank of Montreal was looking to increase its digital experiences in home equity and mortgage in the US, it collaborated with Blend. As a result of Blend’s digital lending platform, which streamlines online customer journeys while applying for and receiving banking services, the bank saw a 253% YoY increase in digital equity applications.

4. Sustainable finance and increasing investments in ESG

Banks play a key role in driving the transition to a low-carbon, sustainable economy. Sustainable finance is a market that has seen tremendous growth over the last few years. From activities like financing climate-friendly power plants, facilitating social investments in hospitals and schools, and providing preferential pricing to companies achieving sustainable targets, banks are increasing investments in ESG solutions. While the global populace combats climate change, banks too are playing their part in financing the transition to net-zero.

JPMorgan Chase, for instance, recently joined the movement in setting large sustainable finance goal targets aligned with the Paris Agreement. Investing over USD 2.5 trillion across a 10 year period to advance sustainable development, climate action, and facilitate the transition to a low-carbon economy.

HSBC too has set aside up to USD 1 trillion over the next decade for financing ESG solutions and prioritizing investments in transitioning customers to lowering carbon emissions.

HSBC Bank USA, recently announced its offering of Sustainability-Linked Loans (SLL) that will facilitate businesses in the US to tie their borrowing to support sustainable activities. Employing this SLL solution to fund full sustainability in their supply chain processes, Mercon Coffee Group partnered with HSBC in the first example of a coffee-only sustainability-linked credit agency.

Bank of America’s latest initiative is a one-of-a-kind USD 2 billion Equality Progress Sustainability bond. Addressing social and environmental issues concurrently, the bond is designed to reduce inequalities for the Hispanic-Latino and Black communities in the US.

5. Re-skilling/Upskilling the workforce

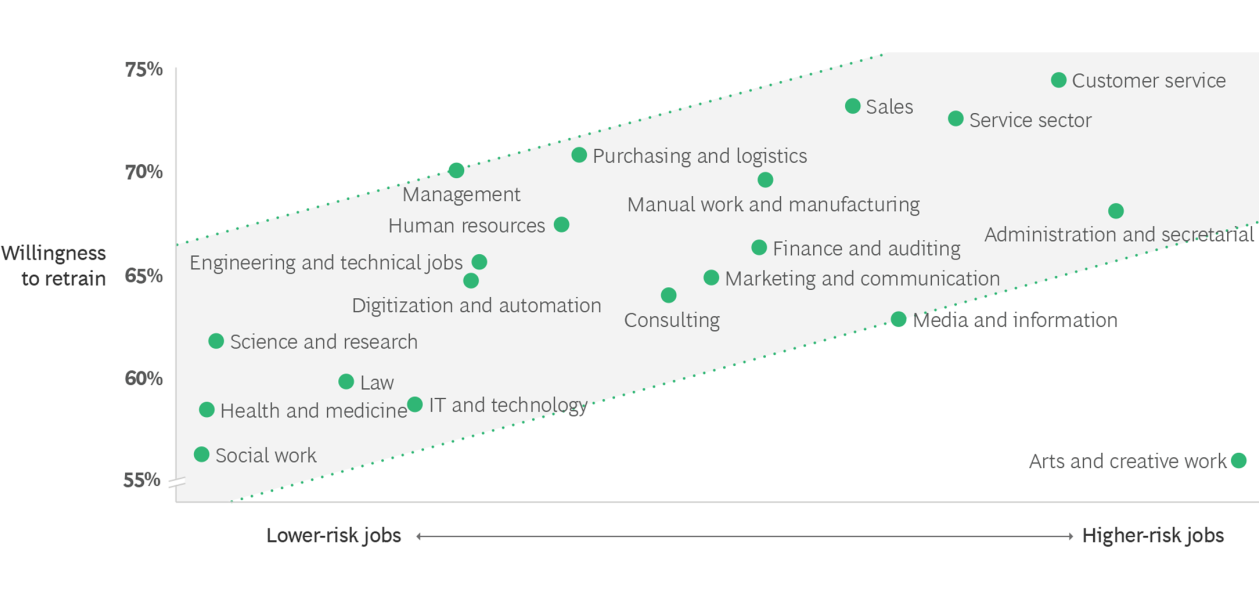

With job roles facing disruptions from their traditional mode of operations to digitally sound models, building an intelligent workforce and workspace has become key. Since most customers transact remotely, this requires employees to be equally agile and drive the digital vision of their bank. Even as banks saw a major shift in the execution of their operations, financial service firms are required to re-invent themselves for seamless delivery of customer offerings from work-from-home setups. With a constant need to reskill and upskill to maintain relevance and build operational efficiency, today, retraining willingness across sectors exceeds 70%.

Banking recovery post-COVID-19 has increased training opportunities with firms upskilling their existing human resources to be more tech-ready, think on their feet and be proactive under pressure. Today, bank employees have largely upskilled their technical prowess in providing remote services, acclimatizing during crises, and being acquainted with back-end support along with their usual profile. McKinsey’s research indicates that effective reskilling is 20% more cost-effective than hiring new employees and laying off old ones. Employees begin to form closer relationships with their firm and gain a large skill set that is only beneficial going forward.

Bank of America’s employees, in reskilling efforts, have completed over 4.2 million courses. In fact, the bank’s division for global technology and operations is committed to filling 80% of open roles with internal hires. In an age where automation is taking over and reducing job creation, reskilling to adapt to emerging technologies and newer roles is especially important.

6. Re-defining customer relationship management

With new emerging touchpoints, closely integrating all systems of operation ensures customers enjoy a seamless experience with their bank. It is important now more than ever to demonstrate real proximity with customers. This generates customer trust and strengthens the bank-customer relationship.

Most customers today prefer an easily accessible self-service approach like kiosks and ATMs. In one example, in the last year, Regions’ mobile app saw 9% growth, while digital banking originated person-to-person payments saw a staggering 142% increase.

Customer-friendly schemes for simplified digital banking via apps are accelerating. Several banks offer smart banking services through their online portal with 24/7 virtual support. Maintaining transparent communication and offering all-day support builds customer confidence.

Today, banks have multiple schemes to engage customers and build lasting relationships that extend beyond banking. For instance, India’s IDFC First Bank recently launched a ‘Ghar Ghar Ration’ program – an employee-funded program for low-income customers whose livelihoods have been affected by the pandemic.

Today, smart financial institutions need to be proactive about their digital strategies. Now is the time to become hyper-vigilant to customer needs and staff journeys. Seriously listening to direct feedback and data and to onboard relevant partners will help financial institutions make smart decisions based on that data.

In an increasingly fast-paced financial space, companies need to constantly evaluate the market and expand their offerings. Netscribes helps you track the emerging trends and market shifts in the financial services industry with its market intelligence solutions. To know more, contact us.