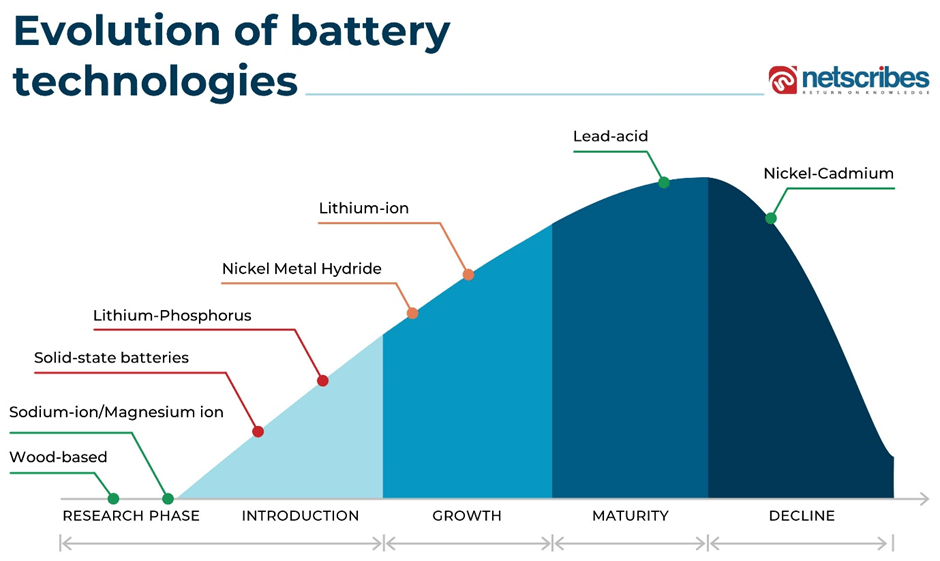

How battery technologies are expected to evolve in the future

In recent years, electric vehicle sales have grown exponentially, thanks to improved range, broader model availability, and increased performance. In CY2021, electric car sales grew four-fold over CY2019, according to IEA.

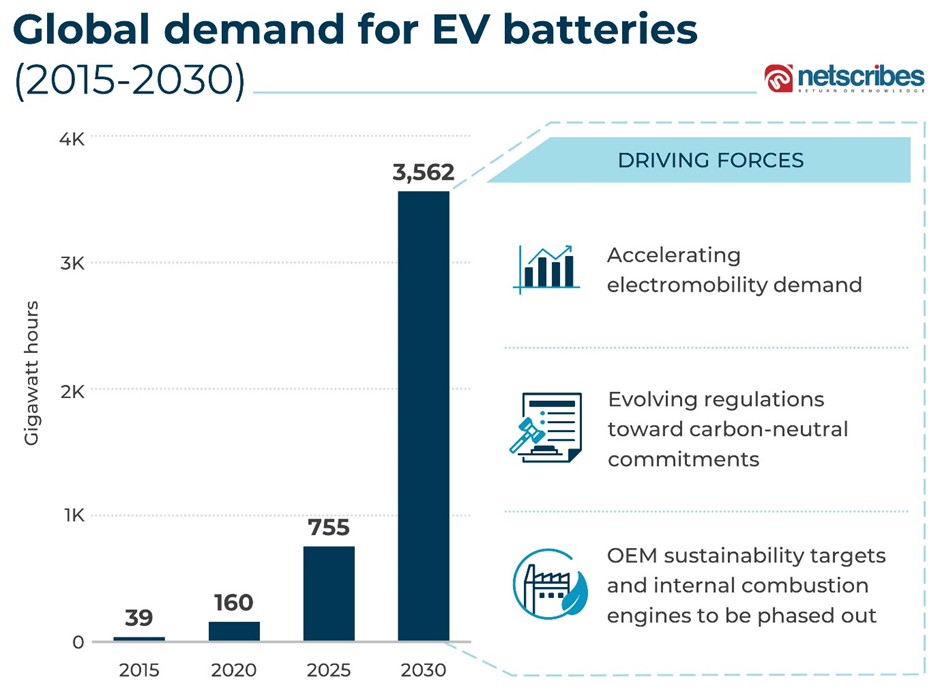

The growing demand for EVs will also boost battery demand. According to another IEA report, battery demand will grow 17-fold between 2019 and 2030. To reduce the risk of bottlenecks and price increases, it is necessary to increase efforts in diversifying battery manufacturing and critical mineral supplies.

Most of today’s electric vehicles and PHEVs use lithium-ion batteries, which are typically made up of Nickel Manganese Cobalt (NMC) or Lithium Iron Phosphate (LFP).

Challenges associated with existing battery technologies

With the growing popularity of electric vehicles (EV), manufacturers are now considering sustainable battery solutions, as some of the metals used in the current battery technology (Li-ion) have disruptions associated with them. Given below are some challenges associated with the key elements of the battery ecosystem.

Lithium

Lithium mining is associated with environmental conflicts and international trade disputes due to the following factors:

- Environmental conflicts: Lithium mining destroys the soil structure, depletes, and contaminates water resources, ultimately harming environmental ecosystems. Owing to this, indigenous communities in Bolivia, Chile, and Argentina (The Lithium Triangle) have taken legal action over lithium projects for violating the ILO Convention 169 (right to free, prior, and informed consent). This has given sustainable lithium mining a much-needed push.

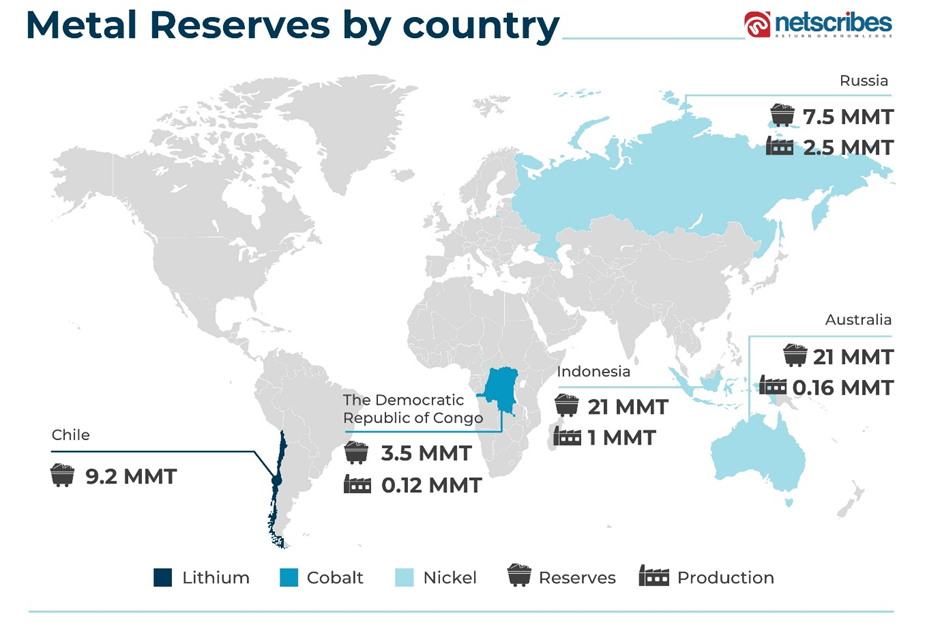

- International trade disputes: There are 47 million tonnes (Mn t) of lithium resources in the Lithium Triangle, which account for 65% of global lithium reserves. Around 12% of the total lithium reserves are in Chile (9.2 Mn t) alone. Latin American economies are trapped in a cycle of declining terms of trade as they export lithium at low costs and import finished technologies at higher prices.

In recent years, Chile has taken steps to break this cycle by limiting foreign control over its natural resources by passing a bill stating that lithium exploitation, industrialization, and commercialization are in the national interest. China, South Korea, and Japan, however, on the other hand, are competing to access lithium further widening the supply-demand gap.

Cobalt

The Democratic Republic of Congo (DRC) is by far the world’s largest producer of cobalt, accounting for roughly 70% of global production. However, the economic unrest in the DRC amidst extreme violence likely escalates regional tensions with the resurgence of the M23 armed group. Moreover, child labor and other serious human rights abuses in the mining sector remain widespread. All of these factors contribute to the widening supply-demand gaps in the battery technology ecosystem.

Nickel

Russia is one of the leading producers of nickel. In the short term, one of the biggest hurdles to the battery ecosystem is the soaring nickel prices caused by the Russia-Ukraine war.

Alternatives to Li-ion batteries

Magnesium-ion batteries

Researchers at the Tokyo University of Science (TUS) have developed a new electrolyte material that improves the conductivity of magnesium ions at room temperature, paving the way for the next step in developing magnesium-ion (Mg2+) batteries. Seen as a lower-cost alternative to lithium-ion, Mg2+ batteries have faced big hurdles due to the poor conductivity of magnesium ions in solids at room temperature.

Sodium-ion batteries

Sodium is a promising candidate for new battery technology. However, the limited performance of sodium-ion batteries has hindered their large-scale applications. A research team from the Department of Energy’s Pacific Northwest National Laboratory has developed a sodium-ion battery with greatly extended longevity in laboratory tests. By modifying the ingredients in the battery’s liquid core, the performance issues that have plagued sodium-based batteries can be avoided. In a study published in Nature Energy, the researchers described a promising recipe for storing solar energy and powering electric vehicles in the future.

Other renewable battery solutions

Battery makers are also exploring renewable battery solutions using lignin-based hard carbon produced with renewable wood from Nordic forests.

Stora Enso and Northvolt have partnered to create a sustainable battery featuring an anode produced from renewable raw materials sourced sustainably and locally in Nordic countries.

How are OEMs adapting to the situation?

OEMs are exploring alternatives to lithium-ion batteries that are less toxic and made from more accessible metals. These include sodium-ion/solid-state batteries (SSBs).

A solid-state battery has higher energy density than a Li-ion battery that uses a liquid electrolyte solution. It minimizes the risk of explosion or fire, so there is no need to have components for safety, thus saving more space. It will likely offer space to include more active materials that increase battery capacity.

“Solid-state batteries for EVs are evolving to the commercial stage. OEMs are aggressively hedging the bets for SSB. They (OEMs) are investing/partnering to build pilot capacities for battery makers while trying to produce their own SSBs.

Start-ups, on the other hand, are transforming the EV landscape with innovations. They are mainly focused on delivering the apt technology, inevitably attracting huge payoffs and investment from OEMs, which will likely solve their issues related to manufacturing concerns, and ease scalability.”-Pranjal Markale, Lead Analyst (Automotive Insights), Netscribes

Key initiatives by OEMs toward SSB

BMW’s first SSB car fleet goes operational: BMW’s first car fleet with SSB (makers call it semi-solid) went operational early this year. The company invested Euro 170 Mn in its pilot line, while it has also invested USD 130 Mn in the US company, Solid Power, along with Ford.

China to commercialize SSB as of Q42022: One of the leading Chinese automakers NIO reaffirmed in July 2022 about delivering 150 KWh SSB in the fourth quarter of 2022. The new battery pack, featuring a hybrid electrolyte, will have a 50% increase in energy density compared to the previous one. Announcing the flagship sedan NIO ET7 at the NIO Day 2020 event on January 9, 2021, NIO said- the 150 KWh solid-state battery will be available for the model starting in the fourth quarter of 2022, giving it an NEDC range of 1,000 km. WeLion New Energy Technology is the NIOs supplier for SSB.

The world’s largest EV battery makers CATL and Samsung remain skeptical of aggressive SSB production claims. CATL has pegged the faraway 2030 year as the timeframe when electric cars with such batteries will truly start to make a market share dent in the industry. On the other hand, Samsung will plan to produce SSB prototypes in 2023.

Related reading: China EV charging stations ecosystem

For over two decades, Netscribes has been helping organizations combat the threat of disruption and build a competitive advantage through holistic technology research. Our ability to draw upon the knowledge based on patent analysis, primary and secondary research, and data analytics helps us provide the most comprehensive and accurate information to support your technology strategy.

Are you interested in evaluating emerging technologies to identify growth opportunities? Contact us to know how we can help.